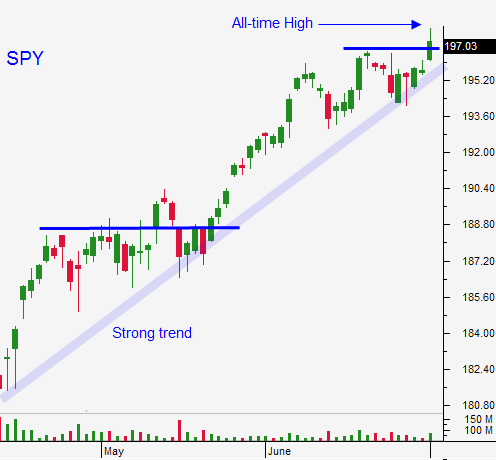

This Dip Will Be Shallow – Asset Managers Will Buy On Strong Economic Data

Posted 9:40 AM ET - The market has not been able to advance after an excellent round of economic data last week. Interest rates are likely to move higher and that is keeping a lid on this rally.

Global PMI's, Chicago PMI, ISM manufacturing, ISM services, auto sales, ADP and the Unemployment Report all exceeded expectations last week. We could be seeing the start of a mild recovery.

Tonight, China will post its trade numbers. Growth has stabilized and fiscal spending programs are bearing fruit. Continued growth in China is critical to this rally. Their shadow banking industry is hanging on by its fingernails and any economic contraction will raise credit concerns.

Alcoa will post earnings today and Wells Fargo will post results on Friday. Bank profits should be good, but the focus will be on interest rates. Higher yields are good for the financial sector and these stocks should hold up well.

The strongest companies announce early in the earnings cycle and optimism will build. Guidance for Q3 will be critical. Perhaps some of the recent economic strength will start to show up in the forecasts for Q3.

Companies are lean and mean and any uptick in demand will go straight to the bottom line. This means P/Es could decline from their current level of 16.5.

Tomorrow, the FOMC will release its minutes. The Fed did not mention any plans to introduce alternative tightening measures and traders will be looking for any hints of when that might happen. Last week's strong Unemployment Report has bond vigilantes on high alert.

The news is fairly light this week and I would not read too much into the small decline the last few days. This should present a nice buying opportunity.

Trading volumes have been light and Asset Managers have not participated in the rally. Now that we have strong economic data, they will be playing catch-up. That means the bid is building and we won't see a major decline.

Watch for an early decline and an intraday reversal. That could happen today or it might take a little longer. That price action will be a sign that buyers have returned and I suggest buying calls when you see it. Also watch for late day strength.

I bought some calls last week and I will add once support is established. This dip will be relatively shallow so don't wait too long.

Use SPY $196 as your stop.

.

.

Daily Bulletin Continues...