Credit Concerns Will Dissipate Quickly – Wait For Support – Buy This Dip

Posted 9:50 AM ET - Yesterday, the opening rally did not hold and sellers probed for support. The price action was very quiet ahead of the FOMC minutes and the initial reaction to the release was bearish. Stocks rebounded on the news, but they were not able to extend the gains into the closing bell.

The Fed comments were rather hawkish. They plan to finish tapering in October. This should not have been a big surprise given the recent employment data, but the market does not want to be reminded that tightening is just around the corner.

When I turned my computer screen on this morning and saw the S&P 500 down 17 points, I immediately suspected a credit issue. That is really the only thing that can spook investors.

One of Portugal's leading banks defaulted on a bond payment. The ECB has been clamoring for two years that they will do anything to prevent a financial crisis - this bank will be bailed out. European banks are loaded with risky sovereign debt and the small fires will be stomped out with greater frequency in the future. Eventually, there will be too many to control.

This bank issue will be resolved quickly. PIIGS yields are on par with US Treasuries and that should change in coming weeks. Risk will be reevaluated and these bonds have rallied to unimaginable levels.

China's trade numbers missed expectations (7.2% versus 10% expected), but they still improved month over month. This news event is not materially impacting the market.

Bullish speculators will get flushed out on this move. The market will probe for support today and the price action could get ugly. Asset Managers have not participated in this light volume rally and they are anxiously waiting to buy a dip. All of the economic releases in the last week have been excellent and global activity is showing signs of improvement. I believe this dip will be shallow and brief.

Earnings season kicked off this week and Alcoa rallied after the release. Demand for rolled aluminum was up 20% and this news bodes well for cyclical stocks.

Wells Fargo will post earnings tomorrow. Banks are expected to report soft results and bad news is priced in. The initial reaction might be a little weak, but financial stocks should gradually catch a bid. Interest rates will move higher and that is good for profits. Global credit concerns should remain low and this Portuguese bank won't spoil the rally.

The strongest companies announce early in the earnings cycle and confidence will be restored quickly.

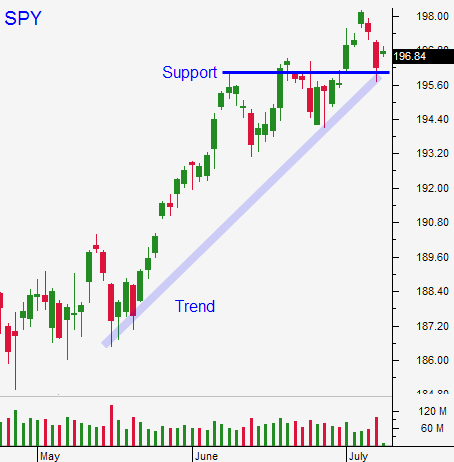

I bought a few calls last week and my position is tiny. If the SPY can get back above $196 this morning and hold that support, I will hang onto my call positions. If it can't, I will take my lumps.

I have been waiting for a pullback and we might finally get one. I want to see a deep intraday low and a sharp bounce. I will buy a few calls when I see that. If I see follow-through buying, I will add.

Major support is at SPY $190. That was the breakout to new highs and it is the 100-day moving average. I don't see us selling off that hard.

Use SPY $196 as your guide and be prepared to buy this dip.

.

.

Daily Bulletin Continues...