The Market Bid Is Strong – Asset Managers Bought All Day – Buy Calls

Posted 9:25 AM ET - Yesterday, the market sold off on credit concerns in Portugal. One of their leading banks defaulted on a bond payment and the S&P futures were down 17 points before the open. This was the perfect opportunity to gauge the bid.

Asset Managers did not hesitate to buy stocks on the open. The market did not even probe for support. Once the rebound was underway, it continued throughout the day.

Asset Managers have been waiting for signs of an economic recovery and they have not participated in this light volume rally. In the last few weeks, the jobs numbers have been excellent and they confirm the recent trend. ISM manufacturing, ISM services and Chicago PMI were also strong. Auto sales climbed to levels we have not seen since 2007. Asset Managers have been waiting for a dip and they got one yesterday. I still believe they will be playing catch-up.

Alcoa kicked off earnings season and the results were good. Rolled aluminum sales were up 20% and cyclical stocks will catch a bid.

Wells Fargo posted earnings this morning and they were in line. Mortgage revenues were down and bad news is priced in for the entire sector. Interest rates will start creeping higher and that will be good for profits. I believe traders will look ahead and financials will start to move higher as earning season unfolds. Yesterday’s credit concerns quickly dissipated.

The strongest companies announce early in the earnings cycle. Optimism builds and we should see bullish price action today and next week.

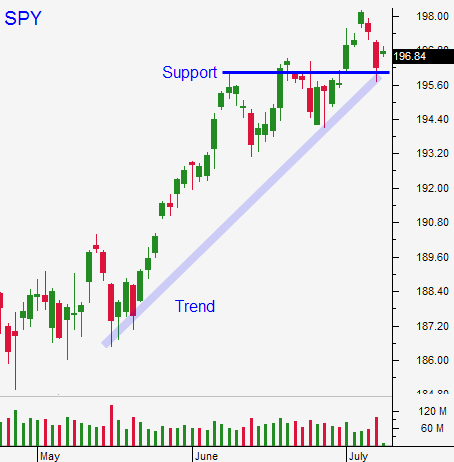

Yesterday I held onto my calls and I added to my position when the market did not probe for support. The SPY easily climbed back above $196. Use that level as your stop.

I still only have 30% of my normal position allocated at this time. I have been able to catch most of the moves by day trading and I don't see a need to take overnight risk.

Keep your size relatively small. If the guidance is good and the market makes a new high, add to your positions and move your stop up.

.

.

Daily Bulletin Continues...