Focus Will Be On Earnings This Week – Market Should March Higher

Posted 9:35 AM ET - Last Thursday, the market had to deal with a mini crisis and we were able to gauge the strength of the bid. A Portuguese bank defaulted on a bond payment and credit concerns temporarily resurfaced. The S&P 500 was down 17 points overnight and once the opening bell rang, buyers stepped in. Now those losses have been erased.

Asset Managers have not participated in this light volume rally. They have been waiting for proof of an economic recovery. Job growth has been steady for many months and the trend has been confirmed through multiple sources (ADP, JOLT, Challenger Gray & Christmas, initial claims and the Unemployment Report). They waste any time buying the dip last week and the bid is strong.

Global economic growth is decent. China is back on track and it is the cornerstone to this rally. Trade numbers were good last week and fiscal spending programs are starting to bear fruit.

The economic calendar is fairly light this week and the focus will be on earnings. Citigroup is up 4% this morning after posting a 96% drop in profits. Dismal results are priced into the financial sector and it has room to run. Mortgage lending is down and banks will be hit with one-time legal expenses. Interest rates will start moving higher in coming months and that will be good for bank profits. The earnings news this week will be dominated by banks and they need to lead the next stage of this rally if we are going to breakout.

Alcoa reported strong demand for rolled aluminum last week and the stock rallied. This will set a bullish tone for cyclical stocks.

Corporate guidance will be the key the next 2 weeks. Ideally, forecasts will be optimistic and companies will report increasing demand. This would explain the recent rise in hiring.

Janet Yellen will testify before Congress this week. The Fed plans to end tapering in October and they can justify their actions based on recent employment gains. We could see a few jitters during the testimony, but I'm not expecting any new twists.

There are not any spoilers this week and the price action should be bullish. I bought some calls two weeks ago and I added last week. My position is still only 30% of my normal allocation. I have been able to catch most of the moves intraday and I don't feel compelled to increase my overnight risk exposure.

The strongest companies announce early in the earning cycle and optimism will build. If the guidance is strong and we breakout to a new all-time high, I will add to my call positions.

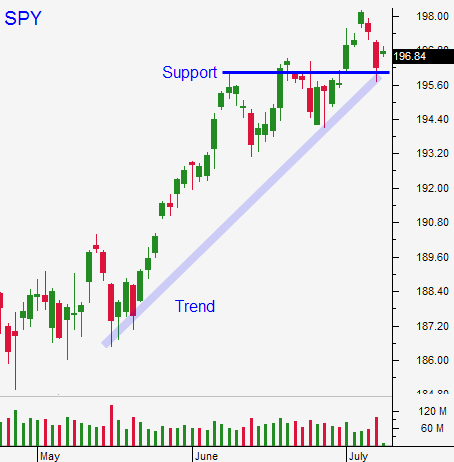

Use a close below SPY $196 as your stop.

.

.

Daily Bulletin Continues...