Market Should Make A New All-time High This Week – Own Some Call Options

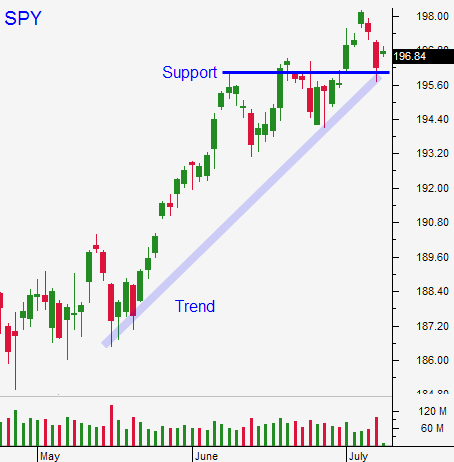

Posted 9:30 AM ET - Yesterday, the S&P 500 opened 8 points higher and it was able to hold onto the gains. The SPY is within striking distance of the all-time high and the losses from last week's “mini dip” have been erased. Asset Managers are still playing catch-up and the bid is strong. We should be able to breakout to a new all-time high this week.

Citigroup posted a huge drop in earnings yesterday and the stock rallied. This morning, JP Morgan and Goldman Sachs are trading higher after announcing. Bad news is priced into financial stocks and they have room to run. Interest rates will start creeping higher and that is good for profits.

Tech stocks have performed well and good news is expected. Intel will post after the close today. They guided higher a few weeks ago and the expectations are a bit lofty. On Thursday, Google, IBM and Seagate will release earnings. Tech stocks need to hold recent gains.

Alcoa posted good results last week and rolled aluminum sales were up 20%. This was good news for cyclical stocks.

The ECB said that they are considering QE. This is bullish for European stocks and potential easing should negate the recent soft patch in economic data.

Janet Yellen will testify before Congress this morning. Her comments are usually dovish and they should be "market friendly".

China will post industrial production and retail sales tonight. Growth has stabilized and fiscal spending programs are kicking in. These numbers should be good.

This morning, Empire Manufacturing was much better than expected. Retail sales rose .2% and that was below expectations. If you strip out gas and autos, retail sales increased .4%.

Asset Managers did not participate in the light volume rally the last two months. They waited for proof of an economic recovery and now they have it. When presented with a small dip last week, they did not hesitate. From the opening bell on Thursday, buyers stepped in immediately.

The news has been good (earnings, central banks and economic releases). The market should be able to breakout to a new high this week.

I suggested buying calls last week and you should be long.

Use a close below SPY $196 as your stop.

.

.

Daily Bulletin Continues...