China’s Economic Numbers Were Good – Intel Will Lift Tech Stocks – Stay Long

Posted 9:35 AM ET - Yesterday, the market took a breather. The selling coincided with Janet Yellen's testimony before Congress. Her comments were consistent with recent statements, but traders did not like hearing that certain tech stocks were “overvalued”. The price action was a little soft, but the damage was contained.

This morning, the S&P 500 is up eight points before the open. China's GDP, industrial production and retail sales came in better than expected. China's growth is the key to this rally and economic conditions are back on track. Fiscal spending programs are bearing fruit and this trend should continue.

Tech stocks will get a boost from Intel's earnings report. They posted strong numbers and growth was consistent in all markets (mobile, data and PC). They also said that the Microsoft XP cycle should last through the end of the year. Taiwan Semiconductor also posted good results.

Bank earnings have been soft, but bad news was expected. JP Morgan, Citigroup and Goldman Sachs all rallied after announcing. Interest rates will start moving higher in the second half and that is good for profits. The financial sector should catch a bid.

Cyclical stocks are also performing well. Alcoa reported strong growth in rolled aluminum. Good economic numbers in China will also help these stocks.

EBay and SanDisk report after the close. Tomorrow, Google, IBM and Seagate will report. Apple and IBM announced a partnership and IBM should be able to tread water. They have reported dismal results for the last four quarters.

The ECB is considering quantitative easing. European economic activity has been very sluggish and potential monetary easing will keep the bid to their market.

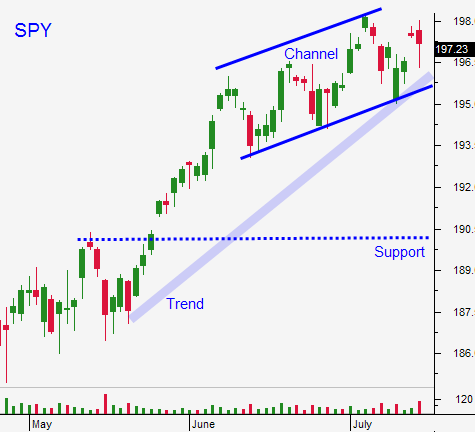

The S&P 500 is poised to make a new all-time high this week. I have suggested buying calls the last two weeks. If you followed my advice, your position should be in nice shape.

Stay long and use SPY $196 as your stop.

The price action today should be bullish. Fed speak won't have much of an impact today.

.

.

Daily Bulletin Continues...