Expect Choppy Trading With An Upward Bias. Market Breakout Still Likley

Posted 1 hour before the open. The market is challenging the all-time high and earnings will fuel a breakout. Bank profits have been better than feared and the financial sector is catching a bid. Cyclical stocks benefited from a strong report from Alcoa last week and from good economic numbers in China this week. Tech stocks have run up recently and strong results from Intel set the tone. The reactions so far favor a breakout.

The S&P 500 is down 11 points this morning (pre-open). Europe and the US have initiated economic sanctions against Russia in a coordinated effort and that is weighing on the market. Europe's economic recovery is fragile and this could impact future growth.

SanDisk posted better-than-expected results. They cited capacity constraints and the guidance was a little soft. The stock is down 10% after posting good results and some traders might wonder if tech has gotten ahead of itself. Google, SanDisk and IBM post earnings after the close today and we won't have to wait long for the answer. Tech stocks have to tread water if the market is going to make a new all-time high.

Janet Yellen testified before Congress this week. Her comments were consistent with previous statements, but she mentioned that some tech stocks might be overvalued. The market did not like the rhetoric and her testimony sparked selling on Tuesday.

The ECB said that they are considering quantitative easing. This is "market friendly" and this should offset the recent economic soft patch in the EU.

China posted better-than-expected GDP, industrial production and retail sales this week. Fiscal spending programs are kicking in and this trend should continue. I believe growth in China is the key to this market rally. Today a construction company said that they will miss a $65 million bond payment. Hopefully this won't raise credit concerns.

Empire Manufacturing was much better than expected and retail sales improved slightly, but missed expectations. The job recovery has been confirmed through many sources (ADP, Challenger Gray & Christmas, JOLTS, initial claims and the Unemployment Report). US economic numbers have been good and they support this rally.

Stocks are not cheap. At a forward P/E of 16.5, good news is priced in. The market has benefited from a lack of attractive investment alternatives. This means that we can expect choppy price action.

Asset Managers did not participate in the light volume rally. They waited for proof of an economic recovery and now they have it. I still believe that they are playing catch-up and that the underlying bid to the market is strong. That means dips will be brief and shallow.

The negative reaction to Russian economic sanctions should quickly run its course this morning. I don't see this as a rally spoiler.

A swift bounce after a couple of hours of trading would be very bullish. This would indicate that buyers are still engaged.

I am long calls and I have about 30% of my normal position allocated. I'm not looking to add at this juncture. If we get strong guidance from companies and the market breaks out, I will consider buying more calls.

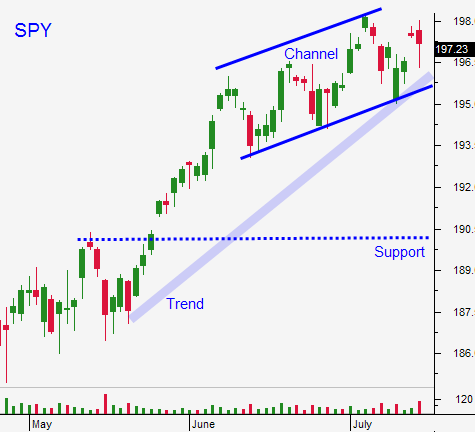

Look for choppy trading with an upward bias. I still believe the market will breakout in the next week.

Use SPY $196 as your stop.

.

.

Daily Bulletin Continues...