Political Events Will Play Out – The Bid Is Still Strong – Be Patient – Use SPY $196 As Your Guide

I spend hours each day researching the market and posting my comments. If you find my analysis to be of value, please CLICK HERE and post a review on Investimonials. This is all I ask in return and your comments keep me going.

Posted 9:50 AM ET - Yesterday, the S&P 500 was down 11 points before the open. Europe and the US imposed new economic sanctions against Russia and the news weighed on the market. I mentioned that this decline would present a buying opportunity. Stocks rallied on the opening bell and the losses were immediately erased. The tone changed dramatically after a few hours of trading.

A commercial airliner was shot down by Ukrainian rebels and an already tenuous situation escalated. Governments are gathering information and the repercussions won't be known for a few more days. At very least, Russia supplied the surface-to-air weapons to Ukrainian rebels.

Additionally, the conflict between Israel and Hamas escalated. Israel is sending in ground forces into Gaza.

The market sold off on the news and once the momentum was established, buyers pulled their bids. I don't believe Asset Managers will buy aggressively ahead of the weekend. They want to see if additional sanctions will be imposed on Russia and there is a possibility that the EU/US will send a few trips to the Ukraine.

Earnings have been decent. Last night, Google was good, and Seagate was a little soft and IBM was okay. Earnings season will explode next week and we will know where we stand. Banks, healthcare and cyclicals have performed well.

Global economic activity is good and a job recovery is underway in the US. Corporate guidance should be positive in light of this trend.

Stocks are trading at a forward P/E of 16.5. Good news is priced in and there is room for profit-taking. That means that we are likely to see choppy trading with an upward bias once all of the political news plays out.

I sold my calls yesterday when the S&P 500 was down 13 points. Here is how I would play the market today.

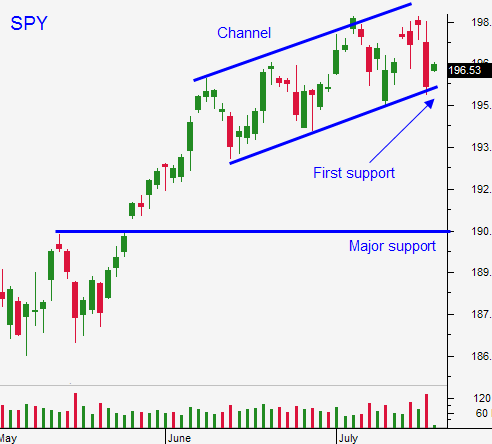

If you held onto your calls yesterday, use SPY $196 as a stop. The market opened above that level this morning.

If you do not own calls and the market is above SPY $196 near the close, buy some.

I believe this early bounce will stall this morning and the downside will be tested. I plan to stay on the sidelines unless I see a late day rally that takes us back above SPY $196. There is too much uncertainty heading into the weekend and I don't see that happening.

Use SPY $196 as your guide.

.

.

Daily Bulletin Continues...