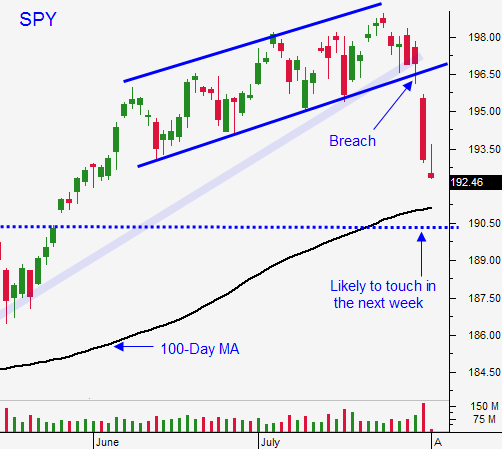

The Market Will Test the 100-Day MA A Second Time – That Will Be A Better Buy

Posted 9:45 AM ET - Yesterday, the market probed for support early in the day. Buyers stepped in and stocks rebounded. I don't trust the first bounce after a big decline and I believe we will retest the 100-day moving average.

As I outlined in Monday's comments, I dipped my toe in the water. The market made a new high for the day after a few hours of trading and I bought a few calls. My level of conviction is low and my stop is SPY $193.

This morning, the S&P 500 is down seven points before the open. There weren't any major news items to justify the decline. We rallied a little too much yesterday and now we are giving some of the gains back. Expect choppy trading the rest of the week.

ISM services will be posted 30 minutes after the open. I'm expecting a strong number and that could put upward pressure on interest rates.

If you bought calls yesterday, use a tight stop.

If you did not buy calls yesterday, stay on the sidelines and wait for a retest. I would be much more comfortable getting long once the 100-day moving average is tested a second time.

.

.

Daily Bulletin Continues...