The Market Will Test the 100-Day MA In the Next Week. Get Ready To Buy On Support

Posted 11:00 AM ET - Yesterday, the market sold off on interest rate worries. I have been mentioning this likely decline for the last week. Russian economic sanctions and the technical bond default in Argentina played a small role. This soft patch will run its course in the next few days and it will set up an excellent buying opportunity.

GDP spiked 4% in Q2 and that was much better than expected. Today, ISM manufacturing was slightly better-than-expected (57). However, the remaining economic releases have been a little light (ADP, Chicago PMI and the Unemployment Report). Interest rates are starting to move higher, but a full-blown decline in bond prices is still a month or more away.

The FOMC statement was dovish. The Fed still has structural unemployment concerns and they will remain accommodative. They wanted to calm nerves as they start their recess. The next meeting is on September 16th.

Russian economic sanctions could put upward pressure on commodity prices. Europe will feel the impact before we do and it could take a couple of months to play out.

Argentina has been through many defaults and it will come to terms with investors. I don't believe this will turn into a credit crisis – yet.

Earnings season has been excellent and more than two thirds of the S&P 500 companies have reported. On average, revenues are up 5% and profits are up 8%. The guidance has been optimistic.

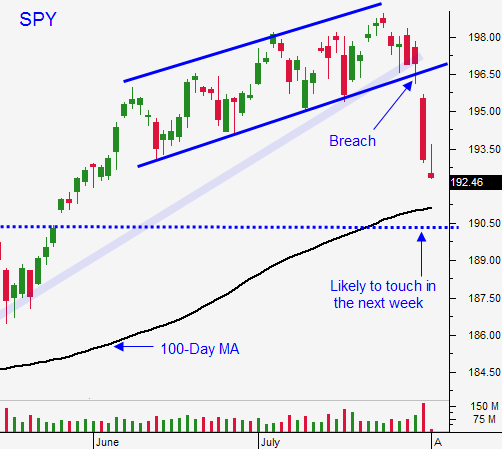

Asset Managers pulled bids once the momentum was established yesterday. We hit an air pocket and bullish speculators were flushed out. There was some technical damage and we are likely to probe for support in the next week. I believe we will test the 100-day moving average (SPY $191) and we will find support at $190.

In the last few years, buying at the 100-day moving average has been an excellent strategy. The market has typically rebounded and exploded to new highs. This time, we will get the bounce, but I don't believe we will make a new high. Stocks will struggle as September approaches. The market will make a lower high and the table will be set for a substantial correction in September/October.

Bond Managers know that the hour is late. They will start adjusting their duration and interest rates will creep higher. Once the Fed ends its bond purchase program (October), the focus will immediately shift to tightening.

Eventually, the market will embrace higher interest rates if they are accompanied by economic growth. However, the Fed's balance sheet has reached unprecedented levels and this adjustment period might take longer than normal.

I am day trading from the short side today. If you are a swing trader, be patient and wait for support around the 100-day moving average. That will present an excellent buying opportunity.

I still think the market will have one more good run. Five-year bull markets die hard and the Fed is still providing a safety net.

A deep intraday low will penetrate the 100-day moving average. It will be followed by a sharp reversal - that will be our sign to get long.

.

.

Daily Bulletin Continues...