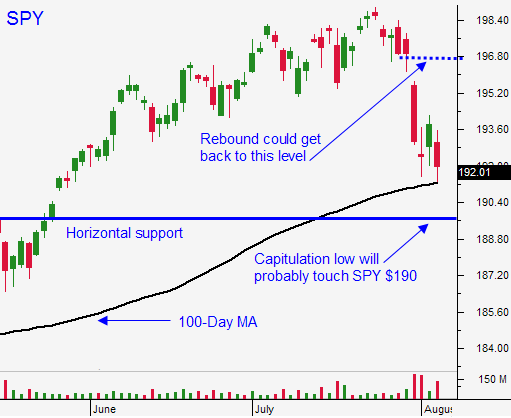

Now We Wait For the Capitulation Low – That Will Be Our Sign To Buy Calls

Posted 9:25 AM ET - In my comments yesterday, I mentioned that a retest of the 100-day moving average was likely and that we still have more work to do on the downside. The bounce Monday was nothing more than a knee-jerk reaction. Stocks opened lower yesterday and the SPY touched the 100-day moving average intraday. This morning, we are getting some follow-through selling.

I had a very small call position on yesterday and I stopped it out for a scratch. The first bounce after a sharp decline rarely gains traction. My stop is triggered and I was out early in the day.

The selling pressure was building Tuesday and Poland's Prime Minister said that Russia was preparing to invade the Ukraine. The S&P 500 dropped 10 points instantly. This news had already been circulated and Russian troops are building on the Ukrainian border. Tension is mounting.

Economic sanctions will start to have an impact in a couple of months. This sword cuts both ways. Colder weather is approaching and Russia will increase natural gas prices. They also plan to ban commercial flights over their airspace.

Economic conditions in the EU are fragile. Italy reported a .3% decline in GDP and they are officially in a recession. Germany's factory orders declined 3.2% and analysts were expecting an increase of .9%. UK industrial production also fell short of expectations. The combination of political uncertainty and an economic soft patch is weighing on European markets.

Credit concerns in Argentina and Portugal seem contained.

The market does not like it when the Fed and Congress are in recess.

There are enough bearish news events to push the market below the 100-day moving average. I would like to see us close below that support level today. Then I would like to see another deep intraday decline and a sharp reversal. That will be our sign start buying calls. When the market closes back above the 100-day moving average, we can add with confidence.

Five-year bull markets die hard and we have enough time for one more run. Tensions in the Ukraine will settle down. Putin is flexing his muscles in response to economic sanctions, but he won't risk war.

The economic soft patch in the EU will be overshadowed by strength in the US and China.

The Fed said that they will remain accommodative after their bond purchase program ends in October. Buyers will be comforted by this safety net and it is still too early for interest rates to move higher. I believe they will start to climb in September.

Earnings season has been excellent. Profits are up 8% and revenues are up 5%. The guidance has been good.

I still believe we will get one nice rally out of this market. Wait for the capitulation low and buy calls. We should see that pattern next week.

Day traders, play the market from the short side until you see the capitulation.

.

.

Daily Bulletin Continues...