Yesterday, the market opened higher and it added to the gains throughout the day. The price action w

Posted 10:00 AM ET - Yesterday, the market opened higher and it added to the gains throughout the day. The price action was decent, but it lacked the gusto that we've seen off of previous capitulation lows. I am moving my stops up to protect my profits.

China's economic numbers were little light on Wednesday and retail sales in the US missed expectations (0% versus .3% expected).

This morning, EU preliminary GDP rose .7%. That was in line with expectations, but the recovery is fragile.

The Ukraine turned back the Russian humanitarian convoy, but Putin will still try to enter the country. Overnight tensions have eased slightly. This conflict will escalate in coming months. Russia will hike natural gas prices as temperatures fall and this could impact European economic growth.

Congress and the Fed are in recess. Earnings season is winding down and the economic releases are light.

There is not much news to drive the market and many traders are taking time off before their kids go back to school.

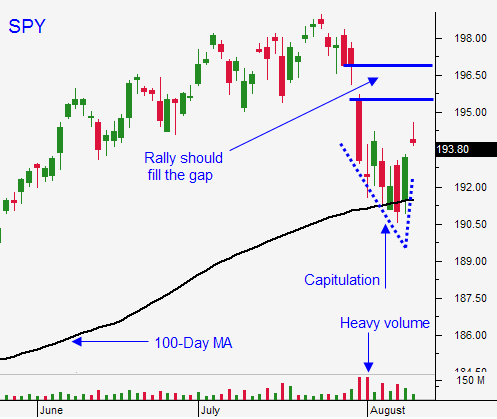

The SPY stayed above $194 yesterday and I am still in my call positions. I am moving my stop up to SPY $194.50.

In the last two years when the SPY has breached the 100-day moving average, we have seen violent snapback rallies. The buying was fast and furious for at least a week and the market ultimately made a new relative high after the capitulation low. We are not seeing an explosive bounce and that tells me that Asset Managers don't feel like they are going to miss the next big rally.

Raise your stops and protect profits in this light volume environment.

.

.

Daily Bulletin Continues...