Tenuous Buying This Week Is Not A Good Sign – Protect Profits – Move Stops Up

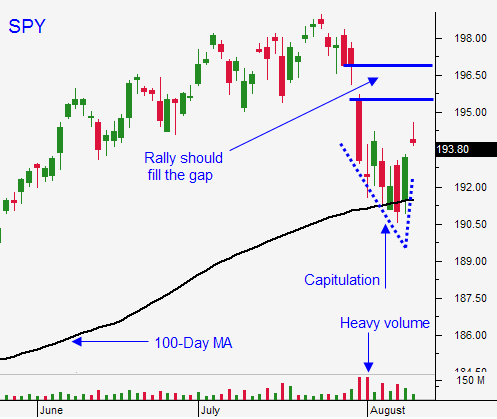

Posted 10:00 AM ET - Last week, the market tested the 100-day moving average a second time and buyers sparked a sharp reversal on Friday. That marked a capitulation low and this pattern has typically produced sharp five-day rallies in the last two years. We are not seeing that this week and my gut tells me that this move might simply be a temporary bounce. Move your stops up to SPY $194 and protect profits.

If you look at a longer-term chart that includes the 100-day moving average, you will see that once the capitulation low has been established, we get strong follow-through buying. In fact, the buying has been so strong that the market makes a new relative high. We should not have seen tenuous price action this early. Asset Managers are not worried that they will miss the next big move.

The Ukraine is not letting the Russian humanitarian convoy into the country and the conflict could escalate.

China's industrial production and retail sales were lighter than expected. I was forecasted a good number and strength in Asia would have offset a weak European GDP number tomorrow. Furthermore, Japan's GDP declined 6.9%. That was expected due to the tax hike in April.

Retail sales in the US were flat (0%). They showed slight improvement last month and I was expecting a better number (.3% consensus estimate). This is a bad sign as we head into “back to school” season.

EU economic data has been soft during the last month. Russian economic sanctions have cast a dark cloud over their markets. A weak preliminary GDP number tomorrow and escalating tension in the Ukraine will weigh on their market.

I expected a much stronger price action this week and better news in China/US. I am raising my stop on my call positions to SPY $194 today.

The early price action looks good, but we need to see a steady grind higher. Today the SPY needs to close above $194.70 (Monday's high) for me to stay bullish. If this move does not gain traction, it will falter and we will test the 100-day moving average.

The news is very light and all of the puzzle pieces needed to fall into place this week if we were going to challenge SPY $196. That did not happen and I am in profit protection mode.

Error on the side of safety.

.

.

Daily Bulletin Continues...