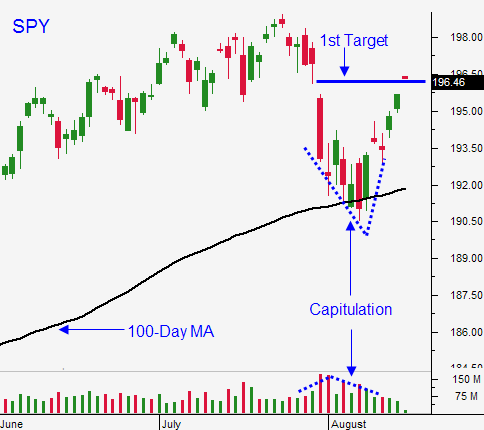

Rally Starting To Gain Traction – Move Your Stops Up To SPY $196

Posted 10:00 AM ET - I don't advertise on this blog and my only reward is your comments. Unfortunately, I did not get any the last time I asked. Please CLICK HEREpost a review on Investimonials. My comments have been spot on and we bought calls on the capitulation low last week. Thank you for taking the time.

The market tested the 100-day moving average last week and we saw a capitulation low last Friday. Stocks were little sluggish early in the week, but the momentum is gaining traction. The news is very light and that favors the five-year bull rally.

Europe's GDP was soft this week and Japan's GDP fell 6.8%. China's numbers (retail sales and industrial production) were little light as well. Retail sales in the US were flat and analysts expected an increase of .3%. Empire Manufacturing and Industrial Production were in line today.

Tension in the Ukraine has eased. Kiev inspected the Russian convoy and it looks like they will let it through. This is good news for European markets since a conflict and additional economic sanctions would hurt growth.

The next big news release is the FOMC Minutes on Wednesday. Interest rates will start moving higher in September and this news release could provide a speed bump next week. The Fed said they would remain accommodative, but officials could be divided.

Flash PMI's will be released on Thursday and they should generally be good.

The path of least resistance points higher and we should see a positive tone through Labor Day. We are only 30 S&P points from the all-time high and the resistance will start to build.

I have nice profits in my call positions and we reached my first target - I am moving my stop up to SPY $196. If the market can't close in positive territory today, I don't want to risk profits over the weekend.

DC is in recess, earnings season has almost ended, the economic news is light and traders are taking time off before their kids go back to school. Expect a low volume environment.

Protect profits and move your stops up to SPY $196.

.

.

Daily Bulletin Continues...