Strong Economic News and Dovish Statements From the ECB Will Push Stocks Higher

Posted 10:50 AM ET - Russia and the Ukraine have agreed to a cease-fire and global stock markets are up. The S&P 500 is making a new all-time high.

The economic news has been excellent. Last week GDP, durable goods and Chicago PMI exceeded estimates. ISM manufacturing was better than expected yesterday and new car sales in August were robust. The Beige Book will be released this afternoon and the news should be good.

Tomorrow, ADP and ISM services will be released. Both numbers should be market friendly. Analysts are calling for 200,000 new jobs when the Unemployment Report is posted Friday. This would be a Goldilocks number.

The ECB will make a statement tomorrow. Many analysts believe that they will outline QE. I'm not that optimistic because of the lip service we've gotten the last two years. We can expect dovish comments from Draghi.

The FOMC will release its statement in two weeks. Janet Yellen has stated that they will remain accommodative even after the bond purchase program ends. Interest rates are at historic lows and Bond Managers believe her.

Corporate earnings were excellent and we actually saw decent top line growth. This could be the uptick in demand we have been waiting for.

The only real spoiler for this rally is credit. Debt levels are astronomically high, but central banks are printing money. Credit spreads remain low and this is a sign that fear is low.

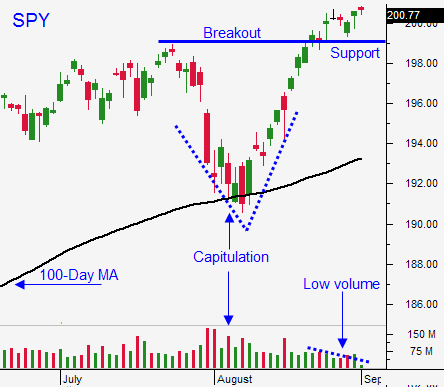

Any pullback will be brief. Asset Managers have not participated in this light volume rally and many are playing catch-up.

I bought a few calls yesterday and if the early gains hold today, I will buy more. I will gradually scale in and I will build to 20% of my normal allocation. When we get past this round of economic news and the volume returns, I might increase my exposure.

The news events this week should be bullish. Look for opportunities to buy calls.

.

.

Daily Bulletin Continues...