No Spoilers – Look For Positive Price Action This Week – Gradually Buy Calls

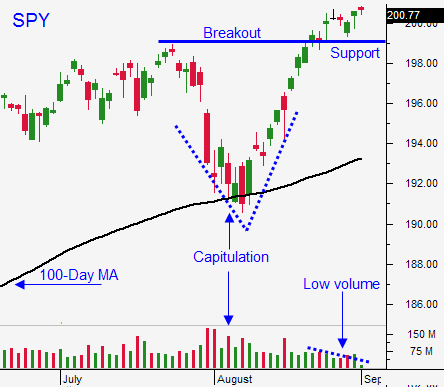

Posted 9:55 AM ET - The market has been melting up on light volume. Stocks typically do well ahead of major holidays and the path of least resistance is up. We are making a new all-time high and volume should return later this week.

Geopolitical events are not spooking investors. Russia invaded the Ukraine and the market barely flinched. Even a full-blown war might have very little impact.

The FOMC will meet on September 16th. They are two months away from terminating their bond purchase program and the focus will immediately shift to tightening. Janet Yellen has assured the market that the Fed will remain accommodative. Interest rates are at historic lows and Bond Managers don't seem worried that rates will move higher.

ISM manufacturing will be posted 30 minutes after the open. The number should be strong. Last week, GDP, Chicago PMI, durable goods and consumer confidence were better-than-expected.

ISM services and ADP will be released on Thursday. Both numbers should be market friendly. Analysts are projecting 200,000 new jobs when the Unemployment Report is posted on Friday. That is a Goldilocks number.

Earnings season was excellent. Revenues were up 5% and profits were up 8%.

I don't see any spoilers until the FOMC meeting. I will gradually scale into call positions this week. I want to see volume return and I'm only going to build to 20% of my normal size.

The last stage of this rally has come on light volume and it feels a bit "fluffy". Interest rates are my primary concern. If they start ticking higher, I will tighten my stops.

Look for positive price action this week.

.

.

Daily Bulletin Continues...