Buy Calls – All of the News This Week Has Been Bullish – Use SPY $199 As A Stop

Posted 9:55 AM ET - The market is trying to grind higher, but it needs to consolidate recent gains. We’ve seen a pattern the last few days where we open higher and the gains gradually erode throughout the day. The news has been excellent and under-allocated Asset Managers will start getting more aggressive with each passing day.

The ECB lowered interest rates today. The expectations were high and the market was up ahead of the news. Central banks (ECB, BOJ, PBOC and the Fed) are accommodative.

ADP reported that 204,000 new jobs were created in the private sector during the month of August. This was a Goldilocks number and it bodes well for tomorrow's report. Analysts are expecting 200,000 new jobs and we are likely to exceed estimates. ISM services will be released 30 minutes after the open and I'm expecting a good number.

In the last week we've had fantastic domestic releases (GDP, durable goods, Chicago PMI, ISM manufacturing, Beige Book, and ADP). Auto manufacturers reported that new car sales are on pace to hit 17 million - the highest level since the financial crash in 2008.

Earnings season was excellent. Corporations are lean and mean and any uptick in demand will go straight to the bottom line. Q2 revenues were up 5% and that was encouraging.

Geopolitical turmoil is not impacting the market.

I am expecting interest rates to move higher. The FOMC is less than two weeks away and the pressure will build. This is the only speed bump I see in September. As long as the rise is gradual, the market will shoulder higher yields.

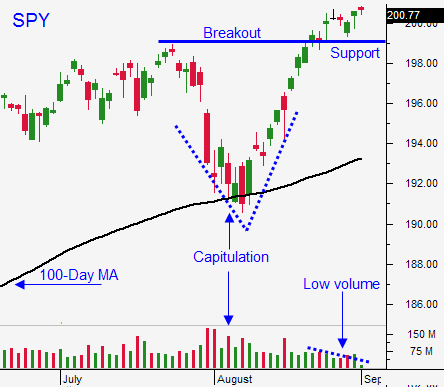

I bought calls on Tuesday and I added to my position yesterday. I will complete the first leg of my position today (20% of my normal allocation). If the market is able to advance and the volume returns, I will add into strength next week. My stop is SPY $199.

Gradually buy calls.

Watch for a strong move higher where the gains hold. That will be the sign that the market is ready to move higher. It could happen today, but I think we need to spend more time at this level.

.

.

Daily Bulletin Continues...