Worst Trading Scenario – The FOMC Kept “Considerable Time” In the Statement

Posted 9:15 AM ET - From a trading standpoint, yesterday's FOMC statement resulted in a worst-case scenario. The Fed left "considerable time" in their statement and we did not get the blow-off rally. Traders immediately wondered if the phrase would be removed in October and the S&P 500 finished flat after the announcement.

Now we will be looking over our shoulder every time a Fed Official opens their mouth. Strong economic data will weigh on the market and "good news will be bad news".

I suspected that the Fed would leave the phrase in. They want to end the bond purchase program in October before they move the tightening timetable forward. This tactic will reduce the shock and trading should be relatively calm.

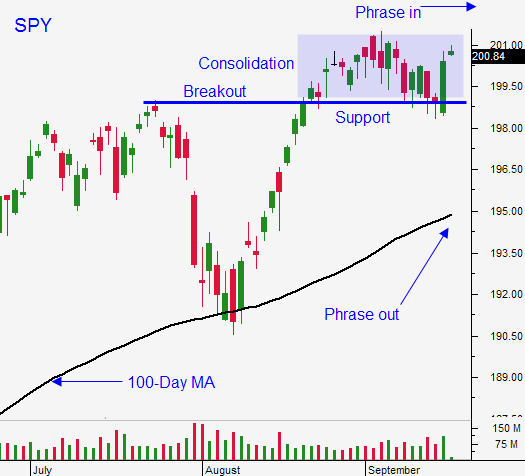

As traders, this is not what we wanted. If the phrase had been removed, we would've seen a swift decline to the 100-day moving average. Once support was established, buyers would have stepped in and a nice year-end rally would have fueled us to new highs. I would have aggressively purchased calls if this scenario unfolded.

Even if the Fed moved its tightening timetable forward, I don't believe that interest rates would have spiked. Central banks are easing, global inflation is low and US bonds rally on uncertainty. All of these factors would keep a lid on interest rates and they would gradually move higher. If rising rates were accompanied by economic growth and strong earnings, the market would rally.

I did take a small position yesterday as outlined. They kept the phrase in and I bought calls. I will use Wednesday's close (SPY $200.75) as my stop. As the market moves higher, I will raise my stop. I can't be an aggressive buyer at this level.

Scotland's vote for independence will be known Friday. If they vote yes, the market won't like the news. Any decline will be brief.

Initial claims dropped by more than 30,000 this morning and that was good news. Housing starts and permits were weak.

Flash PMI's will be released next week. China's industrial production and retail sales were little soft last week and we could see a pullback in economic activity. This won't impact the market since the PBOC is easing. Overnight, they lowered the repo rate by 20 basis points. This is the second short-term easing move they've made this week.

We still have to get through the debt ceiling, the end of the bond purchase program, higher insurance rates from HMOs and the November elections. The fundamentals are strong, but these speed bumps loom.

If the market breaks out today, we will see a choppy grind higher. The potential for a big one day retracement will be high and the price action will be event driven.

If the market can't breakout this week, we will be trapped in a tight range until the October FOMC meeting.

Be long, be small and move your stops up as the market rallies.

.

.

Daily Bulletin Continues...