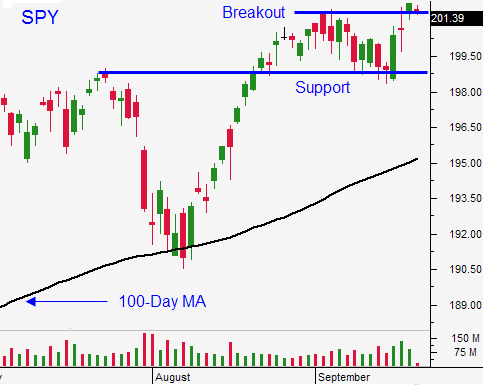

Market Breakout – No Speed Bumps Next Week – Buy Calls and Use Stops

Posted 9:50 AM ET - Yesterday, the market broke out to a new all-time high. Looking ahead, there are not any speed bumps next week and we should continue to march upward.

I took a 20% call position on Wednesday after the FOMC statement. They kept the phrase "considerable time" in their statement and that is bullish. I believe they want to end the bond purchase program in October before they remove the phrase. Once they do, the traders will immediately focus on tightening. The Fed wants to spread the “shock” out and avoid a “double whammy”.

As I've been mentioning, even when the statement is removed, I don't believe interest rates will spike. Central banks are easing, global inflation is low and any global uncertainty leads to a bond rally (flight to safety). All of these influences will keep a lid on rates and when they do start to move higher, they are likely to rise gradually.

Scotland voted to stay in the union (55% vs 45%). European markets liked the news.

Earnings season is a few weeks away and the results should be good. Stocks typically rally into earnings season.

The debt ceiling won't be an issue until it is reached in October. The market will discount the event knowing that Republicans will raise it at the last minute. The GOP wants to stay out of the headlines ahead of November elections.

Flash PMI's will be released next week and they will be soft (EU and China). The market will look past the numbers since the ECB and PBOC are easing.

Now that we have the breakout and follow through, we should continue higher. I will add 10% to my call position today. My stop will remain at SPY $200.75 on a closing basis. That was Wednesday's close and that support needs to hold.

This is a Quadruple Witch and we can expect choppy trading near the close.

My sentiment is getting a little more bullish, but I'm still keeping my size small.

Be long, be small and raise your stops as we move higher.

.

.

Daily Bulletin Continues...