Best Trading Scenario – FOMC Removes Considerable Time From Its Statement Today

Posted 10:10 AM ET - Yesterday, the market reacted to a Wall Street Journal article that suggested the phrase "considerable time" would remain in the FOMC statement today. That would signal that the Fed plans to remain accommodative. I believe this is the most likely scenario. Janet Yellen has cited structural unemployment issues and the Fed does not want to spook the market as it prepares to end the bond purchase program in October.

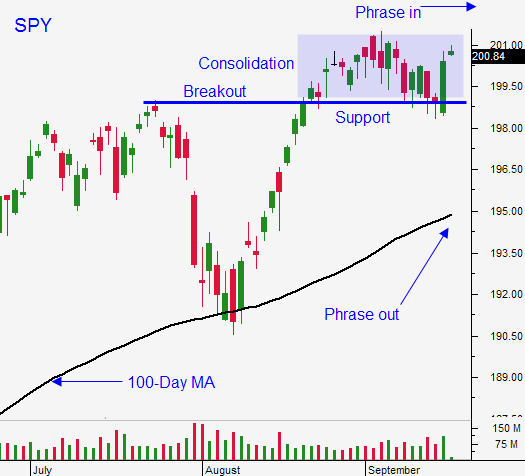

Stocks jumped on the news and we quickly rallied above resistance at SPY $199.

I am frequently asked about the placement of stops so let me spend a few sentences on this. My forecast going into the day was for very quiet trading. I expected a little choppiness, but no big moves. We were just below SPY $199 and I did not want to get "ticked out" of my put trade. That is why I planned to use the close as my guideline. I still felt that bullish speculators were going to get flushed out before the FOMC statement and I wanted to give the trade a little room.

Once I heard the news and I saw the reaction, I exited my put trade. We quickly rallied above $199 and I took a small hit on the position. My forecast for a quiet day was wrong and I needed to adapt. My point regarding stops is to be flexible and know when your forecast was wrong.

There was also another piece of news yesterday. The PBOC injected liquidity and it amounted to a 50 basis point reduction in the bank reserve requirement. This is a very short three-month program and the impact will disappear quickly.

We are faced with a binary event today. Either the phrase is in, or it is removed.

I mentioned that I believe the most likely scenario is for the phrase to remain in. Prior to yesterday, I was in the minority camp (now that has shifted). If this scenario unfolds, the market will rally. We will make a new all-time high on the news. If the move is relatively small (10 S&P points), I will day trade from the long side and I will buy a few calls. If the move is huge (30 S&P points), I will day trade from the long side, but I won't buy calls. I feel that an explosive move will set us up for an excellent shorting opportunity. As soon as the euphoria wanes, traders will start wondering when the phrase will be removed. We will constantly be looking over our shoulders and every strong economic release will prompt profit-taking (good news is bad news).

If the phrase is removed, the market will quickly selloff and we will test the 100-day moving average. In this scenario, I will buy puts. The initial shock will take a few weeks to run its course.

I don't believe interest rates will spike for a few reasons. Global rates are low and central banks continue to ease. Inflation is low and many areas of the world are experiencing disinflation. When geopolitical/credit issues arise, we witness a flight to safety and US interest rates decline. A slow gradual increase in rates would be healthy for the market as long as economic conditions continue to improve.

If the "considerable time" phrase is removed today, we will be able to buy puts with confidence. We should see a nice decline over a period of two weeks. Once support is established, we will be presented with an excellent buying opportunity and we should see a nice year-end rally. This is the best scenario because we won't have to worry about Fed Speak every time a Fed official opens their mouth.

I will not be an aggressive call purchaser on an explosive rally. If the phrase is removed, I will be a little bit more aggressive on the put side.

Either way, today is not the day to load up. It will take at least 15 minutes for the news to be digested and then the direction will be established.

Tomorrow, the dust will settle and we will have a much better feel for the move.

.

.

Daily Bulletin Continues...