Upside Momentum Stalls – We Are Likely To Trade In A Range This Week

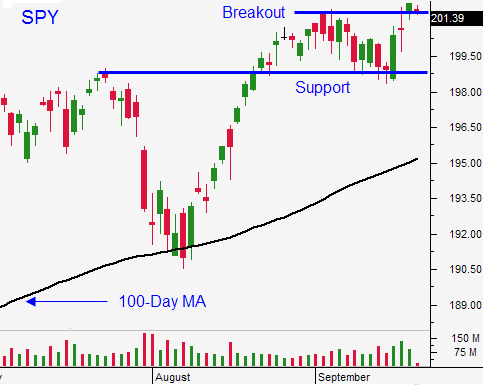

Posted 12:00 PM ET - Yesterday, the market fell below critical support at SPY $199. That represents the breakout in August and this move could flush bullish speculators out of their positions.

I mentioned last week that the favorable FOMC statement could fuel a small rally if the momentum was sustained. We pulled back Friday and I was willing to discount that move as "window dressing" since it was the end of the quarter. However, we had follow-through selling yesterday.

The upward momentum has stalled and the news is light. We are likely to trade in a range between SPY $198 and $202 for the rest of the week (perhaps longer).

The flash PMI's were in line with expectations. China and Europe both finished above 50, indicating economic expansion. The ECB and PBOC are easing and that will keep a bid to their markets.

Over the weekend, China's Finance Minister said that they do not have any long-term stimulus plans. That news sparked a round of selling.

Earnings season is a few weeks away and that should keep buyers engaged. Economic conditions are improving and the guidance for Q3 was good.

The Fed will keep the "considerable time" phrase in its statement in October. They want to end the bond purchase program before they take the phrase out. They know that the focus will quickly shift to tightening and price stability is one of their objectives.

When the Fed does tighten in 2015, I believe the market will go through an adjustment and we could see a correction. However, I don't believe we will see a spike in yields. Central banks are easing, inflation is low and US bonds rally when there is uncertainty (flight to safety). This will keep a lid on interest rates.

A gradual rise in yields is bullish as long as economic conditions continue to improve.

I sold my call positions for a loss yesterday when the SPY fell below $199. I had a 20% allocation and my size was relatively small.

We did not get any follow-through buying and we are likely to trade in a range the rest of the week. I will day trade and favor the short side when we are below $199. I will favor the upside when we are above $199.

The price action this morning is dull and it could stay that way the rest of the week.

We had an opportunity for some nice volatility, but the Fed spoiled that when they kept the phrase in.

Stay sidelined until we break out of the range.

.

.

Daily Bulletin Continues...