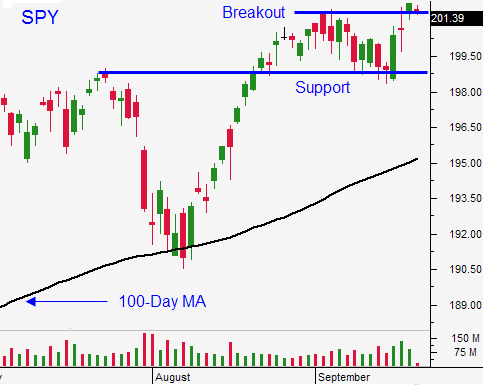

Support Has Been Breached – SPY Likely To Test the 100-Day MA at $195

Posted 9:50 AM ET - Last week, the market broke out to a new high after the FOMC statement. It was not able to sustain the momentum and profit-taking set in. Support at SPY $199 was breached and the selling pressure was broad-based yesterday. Stocks finished on their lower the day and we are likely to test the 100-day moving average (SPY $195).

There are not any huge developments to justify the decline and I believe this is just seasonal weakness. The Alibaba IPO prompted some investors to rotate out of small caps and into the new issue. The Russell 2000 has been very weak.

Flash PMI's in Europe and China were a little light, but in line. The ECB and the PBOC are easing and the damage should be relatively contained.

The Fed left the phrase "considerable time" in its statement and that was bullish. I don't believe they will remove it until November and possibly January. Economic conditions continue to improve and they want to finish the year on a strong note.

Major economic releases will hit next week and good news could be bad news. As long as yields don’t spike, the market will shoulder the news.

Earnings were strong in Q2 and they should be even better in Q3. Earning season starts in a few weeks and that will keep a bid to the market.

The debt ceiling will be reached in October and Republicans will raise it. They want to stay out of the headlines ahead of the November elections.

Any dip will represent a buying opportunity. However, we need to wait for support.

I traded from the short side yesterday since we stayed below SPY $199. If we make a new low after two hours of trading, I will day trade from the short side again today.

Bullish sentiment has been high and speculators are getting flushed out. If you are a nimble trader, stick with the short side until the 100-day moving average is tested. Keep your size small and know that you are going against the grain.

Swing traders, stay sidelined and wait for support. The farther we fall, the better the buying opportunity. Once we test SPY $195, be ready to buy.

From a trading perspective, the best thing that could happen is a nice swift decline. That would get us out of this trading range and it would set up a nice entry point for year-end rally.

.

.

Daily Bulletin Continues...