Upward Momentum Needs To Be Restored Today Or We Will Fall Into a Range

Posted 9:15 AM ET - Last week, we had a bullish FOMC statement. The Fed left the "considerable time" phrase in. That suggests the tightening timetable is still six months out. The market tried to rally, but the move stalled.

End of month window dressing, quadruple witching and the Alibaba IPO (new supply of stock) weighed on the market Friday. Stocks are down this morning and we need to see early support and a reversal. If the market is going to grind higher, stocks need to close on their high today and follow through tomorrow.

Asian markets traded lower and concerns are growing in China. It appears that they are hitting another soft patch and the PBOC eased twice last week. These were very short term moves and the Finance Minister said that they did not have any plans for long term stimulus. The market did not like the news.

Tomorrow, flash PMI's will be released. I am expecting weak results in Europe and in China. Conditions in the US should be good.

Last week I mentioned the worst-case scenario (from a trading standpoint). The Fed left the phrase in and now we will be looking over our shoulder every time a Fed Official opens their mouth. Traders will wonder if the phrase will be removed in October.

Strong economic releases will weigh on the market (good news will be bad news). Bond Managers will sell bonds on the notion that the phrase will be removed in October. Higher interest rates will spark profit-taking.

If we do not breakout early this week, we will chop around.

Ideally, the Fed would have removed the phrase and the market would have declined to the 100-Day MA. That would have resulted in a nice trade on the short side and it would have set up an excellent buying opportunity on support.

Earnings season is a few weeks away and that will keep a bid to the market. The results should be good.

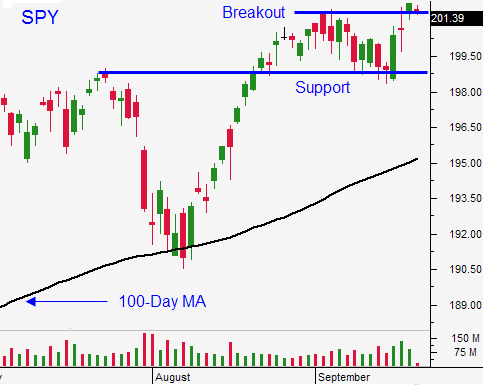

I did not add to my call position last Friday. The market drifted lower the entire day. I am using SPY $200 as my stop (closing basis) and I will use $199 as my stop on an intraday basis.

If the market finds support early this morning and it reverses, we still have a chance to preserve the upward momentum. We need to close on the high and we need to see follow-through buying tomorrow.

If the SPY closes lower today and the flash PMI weighs on the market tomorrow, we will be trapped in a range between SPY $198 and $202.

The Fed kept the phrase in because they want price stability. They want to end the bond purchase program in October before they remove it. They know that when tapering ends, the focus will immediately shift to tightening and they do not want to hit the market with a double whammy.

As traders, we don't want price stability and boring trading ranges - we want volatility.

Let's hope that this little decline was related to the end of the quarter and that the market can quickly regain its footing.

.

.

Daily Bulletin Continues...