The Capitulation Low Is Setting Up A Great Buying Opportunity – Sell Put Spreads

Posted 11:30 AM ET - I sent this video to my High IV subscribers 3 days ago. It includes a trade and I demonstrate how to sell a bear call spread with an actual trade example. The concept is similar to selling a put spread.

CLICK HERE to watch it.

Today I posted a video for HIGH TECH subscribers. We are selling an out of the money put spread now that the market has found support.

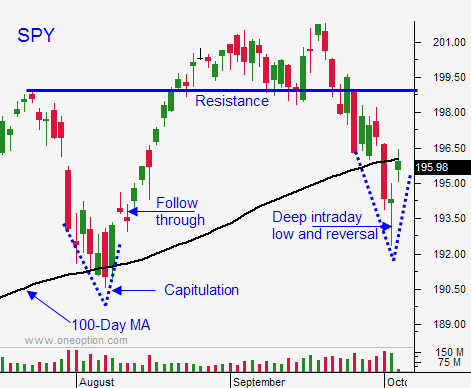

Yesterday, the market probed for support and the S&P 500 was down almost 20 points. Buyers stepped in and bears capitulated. We finished near the high of the day and we have follow-through buying this morning.

We've been waiting for this moment. Swing traders scale into long positions.

The Unemployment Report showed that 248,000 new jobs were created in September. That was much better than expected and the numbers for August and July were also revised upward. When the jobs report came out last month (148,000), I told you it was a farce. Every other economic data point suggested strong employment. The ADP is a much more consistent gauge.

This strong jobs report does have a dark cloud. The unemployment rate fell to 5.9% and that is below the Fed's target of 6%. Traders will wonder if the phrase "considerable time" will be removed from the FOMC statement in a few weeks. Even with this strong report, yields have not moved higher. That is a key component of this rally.

For now, the market has been able to hold its opening gap. I'm a little surprised that we haven't seen interest rates move higher.

The ECB kept rates unchanged and the QE details were light. The market did not like the news. Economic conditions in Europe are slipping.

Ebola concerns will fade next week when there are not any new cases in the US.

People will return to work in Hong Kong after the holiday and protests will subside.

Bullish speculators have been flushed out and this is the buying opportunity we've been waiting for

Earnings season lies ahead and that will attract buyers.

I am selling out of the money put credit spreads this morning. My stop will be based on the individual stock. I want to make sure that technical support lies between the stock price and the short strike price. If that support is breached, I will buy back the put spread. I am favoring this strategy because option implied volatilities will collapse now that market support has been established.

I am still expecting some nervous jitters. We are not likely to challenge the lows from yesterday, but we could pull back to SPY $195 in the next few days. That retest will find support quickly and it will be our opportunity to buy calls.

Sell some put spreads today and wait for the buying opportunity next week.

This late in the day, it is unlikely that we will see this rally reverse. Bonds have been resilient and the gains should hold.

This is the move we've been waiting for.

.

.

Daily Bulletin Continues...