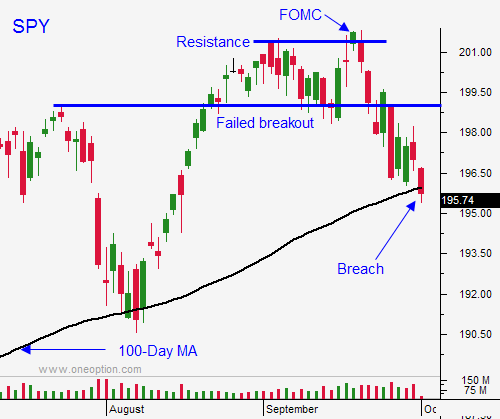

The 100-Day MA Has Been Breached – The Market Will Probe For Support Today

Posted 10:00 am ET - Prospective customers always ask me, "Will your system work in a down market?"

CLICK HERE to watch a video I recorded yesterday. It has all of my stock systems and current trades. Please post a comment on YouTube and let me know if you like these videos.

I mentioned yesterday that there was enough bad news to push the SPY down to $195 and we closed below it. The market will probe for support this morning and we will get a feel for the bid. We've been waiting for this decline and it is important not to jump the gun.

I want to spend a few minutes on the concept of a capitulation low. As long as we are selling off, we haven't hit it. The capitulation happens when bears finally throw in the towel. Typically, we will see a deep intraday low and a sharp reversal. The next day we see follow-through buying. Once I see this pattern, I will sell out of the money put credit spreads so that I can distance myself from the action. Option implied volatilities collapse at this stage and that is what I'm trying to take advantage of.

However, I know that the low will probably be tested a second time. On the retest, I want to see an instant round of buying. Ideally, the market barely touches the low. The next bounce is where I want to buy my calls. There is an old adage, "the second mouse gets the cheese". I have it posted on my desk.

These lows can take time to form. It is senseless to guess. Trading is not about guessing. We need to have price confirmation.

ADP was in line yesterday and we should see a strong jobs report tomorrow (above 200K). Initial jobless claims fell to 287,000 and that is one of the best levels we've seen in years. If the unemployment rate falls to 6%, the Fed will be pressured to tighten and the market won't like the news.

The ECB kept rates unchanged and it released its statement this morning. The reaction has been negative.

Protests in Hong Kong continue. China is celebrating a holiday this week and the crowds will be large. They should be smaller next week when people return to work.

The first Ebola case in the US sent a shockwave through the market yesterday. The market bid will strengthen each day that we go without another case.

I want to sell out of the money put credit spreads, but I will wait for tomorrow's number.

If you are a nimble trader and you are short, use SPY $195 as your stop.

If you are a swing trader, line up your stocks. We might be getting close to a put selling opportunity. As you know from my comments, it is too early to buy calls.

My gut tells me that we will see a bounce fairly soon. It will run out of steam and the market will retest the low as the FOMC meeting approaches. I don't believe the Fed will remove the phrase "considerable time" and the market will rebound. That will be the second bounce.

Earnings season will be excellent and we should get nice follow-through buying into year-end. This forecast is nothing more than a guess at this stage. Along the way, I will be looking for price confirmation. When I see it, I will know what to do.

For today, we will probe for support. If the market makes a new intraday low after an hour of trading, I will trade from the short side. If the market rallies above SPY $195, I will day trade from the long side.

.

.

Daily Bulletin Continues...