This Is One of the Highest Probability Set-ups You Will See – Buy Calls – Size Up

Posted 9:55 Am ET - I will be hosting a free webinar this on Wednesday.

CLICK HERE to register.

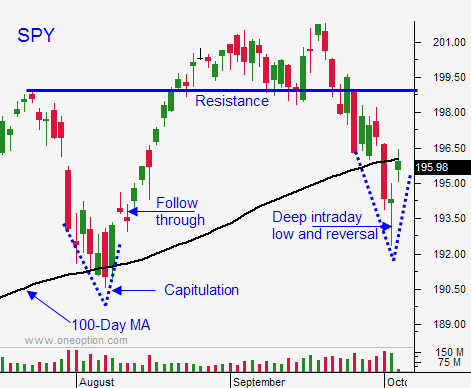

Last week, the market breached the 100-day moving average and it staged a sharp reversal off of an intraday low on Thursday. Bears capitulated and we saw follow-through buying on Friday. The market opened higher this morning and we should have an excellent week.

Friday's Unemployment Report came in above expectations - 248,000 new jobs were created in September. The numbers for August and July were revised higher. Some traders believe that this will force the Fed to remove the phrase "considerable time" from its statement on October 29th. Surprisingly, interest rates did not spike last week and that is bullish for the market.

The protests in Hong Kong are waning as people return to work after the holiday.

Tensions in the Ukraine are subsiding.

There have not been any new Ebola cases in the US over the weekend.

You know from my comments, that these news events were simply an excuse to flush bullish speculators out of the market. Sentiment had gotten to extreme and now we can have a meaningful rally.

Earnings season kicks off on Wednesday and the results should be excellent. The Financial Times conducted a survey of financial executives. They are all expecting robust earnings. This is important since banks post early in the earnings cycle. Financials will set the tone for Q3.

The FOMC does not meet until the end of the month. That gives us at least two weeks of excellent price action before interest rates start to weigh on the rally.

I sold out of the money put credit spreads last Thursday and I bought calls (35%) on Friday. I am adding to my call position today and I will have 70% of my maximum position on by the end of the day. I will add on strength.

I often reference trade size in my comments. There are times when you want to lay low and there are times to spread your wings. This is one of the highest probability setups you will see all year - size up.

Buy calls and look for this bounce to follow-through the rest of the week.

Use the 100-Day MA as your stop.

.

.

Daily Bulletin Continues...