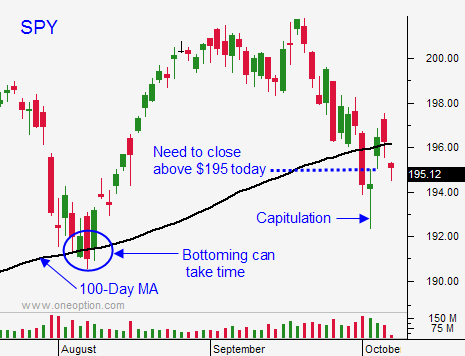

Market Is Searching For Buyers – Retests Are Common – SPY Needs To Close Above $195 Today

Posted 9:55 Am ET - I will be hosting a free webinar this on Wednesday.

CLICK HERE to register.

Last Thursday bears capitulated and the market rebounded sharply. We saw follow-through buying on Friday and stocks gapped higher yesterday. As the day wore on, those gains gradually slipped away. The SPY finished just above the 100-day moving average.

This bottoming process can take a few days and sometimes it takes a few weeks. Today, we will probe for support. The S&P 500 is down eight points before the open. If you look at all of the 100-day MA breaches the last few years, you will see that we always retest.

I believe the process will not take long. Earnings season is upon us and buyers will stay engaged. Banks will dominate the scene next week and they should post strong results. This will set the tone for the rest of the market.

There was an Ebola case in Spain and I'm sure that there will be other isolated cases globally.

The IMF lowered its global growth projections by .1% and they are expecting 3.3% growth this year. This news might be weighing on the market slightly, but it won't have a lasting effect.

Samsung posted weaker than expected results. Cell phone subsidies are starting to disappear and that is lengthening the product cycle.

Our economic activity has been very strong and interest rates are not creeping higher. This is bullish for the market.

Corporations continue to buy back stock at a record pace and will keep a bid to the market. The number of shares outstanding has decreased by 50% over the last 10 years. When more money is chasing fewer shares, the price goes up.

Stocks in Europe were down overnight and it is the weak link. The ECB outlined its QE last week and it fell short of expectations. Draghi said that countries have to do more to help (fiscal spending). Weak data in Germany is the crisis du jour.

I have a 70% call allocation on right now. I got in well last Friday, and I added yesterday when the market clawed back to unchanged. My average cost is just above SPY $195. I don't want to see this market slip away. If we can't get back above $195 after two hours of trading, I will stop out.

If I am stopped out, I plan to get back in when the SPY closes above $196.

I still believe this will dip result in a fantastic buying opportunity. Europe has been weak all year and their GDP is barely in positive territory. Money will flow into our market as it has all year and stocks will catch a bid.

If the market can't get back above SPY $195 this morning, stop out. If it does get back above $195, use that as a closing stop. We want to finish above $195 today. We just started building positions down here so don't let this get ugly. Keep your losses small.

.

.

Daily Bulletin Continues...