Earnings Season Should Attract Buyers – Wait For Support – Sell Bull Put Spreads

Posted 10:00 AM - If you want intraday comments, consider getting my trading platform ($60/quarter). I have been updating users during these crazy moves.

CLICK HERE TO LEARN MORE

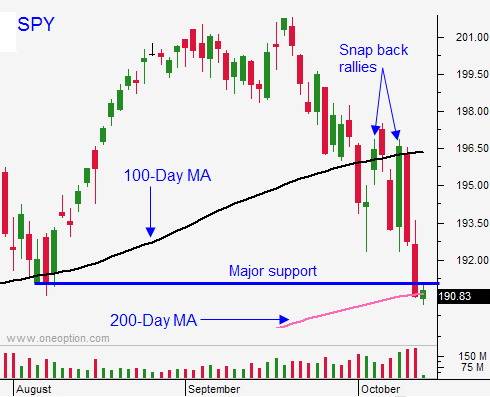

The daily market whip saws that we've seen in the last two weeks culminated with a steep decline last Friday. The S&P 500 closed below the 200-day moving average. The market has not closed below that level in over two years. Fortunately, October is still young and we have time to establish support.

Major technical damage has been done and Asset Managers are not worried that they will miss a year-end rally. European economic activity is slipping and the ECB said that it is out of bullets.

Germany's industrial production fell 4% and their trade balance hit a five-year low. They do not have any fiscal stimulus plans. Standard & Poor's downgraded France's outlook to negative from stable. Their unemployment rate is above 10%. These are the two largest economies in the EU. If conditions continue to slip, credit concerns will surface.

China's trade balance was released over the weekend and it was good. They will post industrial production and retail sales next Monday. This will be a major economic release.

Ebola has been another concern. One of the healthcare workers in Texas contracted Ebola. This has the potential to ignite fear if it spreads across the globe.

Wells Fargo, JP Morgan and Citigroup will post earnings tomorrow. I am expecting good results and this should attract buyers.

The strong dollar could provide and earnings headwind. However, falling oil prices are good for consumers and retail stocks should benefit into year-end.

Corporations continue to buy back shares at a steady pace. Interest rates are at historic lows and US equities are attractive on a relative basis.

I don't like trading against a five-year trend and seasonal strength. This bottoming process will take longer than normal and I will wait patiently for support. I still want to trade from the long side, but I sense that my trading in 2015 will be more neutral than it has been in years. The upward bias will lose its strength and we will see two-sided price action.

The market is oversold and option premiums are getting fat. I want to sell out of the money put credit spreads. As you know from my comments, I believe US retailers will do well ahead of the holiday with gas prices falling.

Once the opening bounce stalls this morning, the market will probe for support. If we bounce with vigor and we trade back above the 200-day moving average the rest of the day, I will sell some out of the money put credit spreads. If the market does not dip much this morning I will sell put spreads. I will sell more on follow-through tomorrow.

I won't be buying calls until we have a bounce and we successfully test the lows (the second mouse gets the cheese).

Option premiums are rich and you need to be a seller.

If you own puts, consider taking some profits this morning. This is a major support level and it should hold. If we continue to drift lower throughout the day, you will still have a position and it will be easier to manage.

Snapback rallies can be violent - the price action last week was proof.

Look for choppy price action today. Bonds are not trading (holiday). The market should stabilize as earnings season unfolds.

.

.

Daily Bulletin Continues...