Market Will Find Support – Focus Will Shift To Earnings – Watch the Video

Posted 9:45 AM ET - I recorded this video last night. It includes market analysis and a trading strategy with examples.

CLICK HERE TO WATCH IT

Yesterday, the market treaded water all day and it fell apart in the last hour. The selling pressure was heavy and we closed on the low of the day. This wave of selling has an element of panic and I believe Ebola might be spooking investors. Margin calls are resulting in forced liquidations and that is fueling the decline.

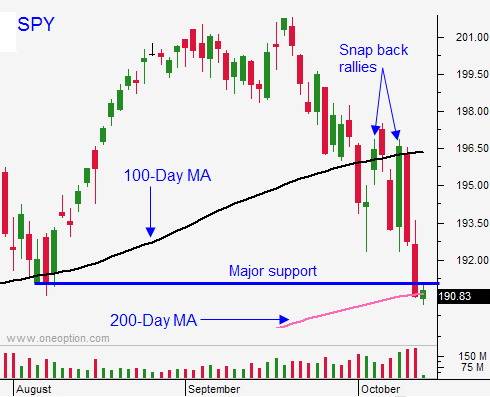

The S&P is below the 200-day moving average. This was a major line of support and I thought it would hold. - it was a horizontal support level from August.

Many traders sell out of the money premium and the 20-day Bollinger Band (two standard deviations) was breached on Friday. Those shorts are scrambling to adjust. They are buying back some of their puts and they are shorting the S&P futures. Both put downward pressure on the market.

A hospital worker in Texas contracted Ebola after working with the patient from Liberia. This fear factor is almost impossible to gauge. If we go a week without another incident, the market will stabilize and the focus will shift to earnings.

A flight to Boston was evacuated and passengers were checked for Ebola. The results were negative, but this demonstrates the level of fear.

J.P. Morgan (down $1.00), Wells Fargo (down $.70) and Citigroup (up $1.20) all posted earnings this morning. I was hoping for a better reaction. Johnson & Johnson posted good numbers and it is up $.78.

Earnings season is about to kick off. That is usually bullish, but there could be some headwinds. Microchip (MCHP) announced that it sees an inventory build and a soft patch ahead. This has been weighing on the semiconductor group. China's excavator sales dropped 33% year-over-year in September. This will put pressure on heavy equipment stocks. A strong US dollar will also reduce profits.

Economic conditions in Europe continue to slip. Industrial production fell 1.8% and that was worse than expected. The ECB is out of bullets and Germany is reluctant to increase fiscal spending. France's outlook was downgraded from stable to negative by S&P. If conditions continue to deteriorate, credit concerns will surface.

This has been the deepest selloff we've seen in two years. Now that major horizontal support and major moving averages have been breached, we are in no man's land (no visible signs of support). I used a Fibonacci extension to calculate that we could go as low as SPY $184 before finding support.

I've painted a very bearish picture, but I am still looking for a bounce. I won't stick my head in the noose - I need to see bona fide support. It will come in the form of a snapback rally that does not look back. We need to see buying into the close and follow through the next day. The S&P also needs to rally above the 200-day moving average.

I suggest taking profits on some of your put positions (scale out). If the market stops going down, your puts will lose value (implied volatility collapse). Once you lock-in profits, it will be easier (from an emotional standpoint) to manage your remaining positions.

When we do get the bounce, don't buy calls. Seasoned options traders can sell put spreads (credit spreads) and use the proceeds to purchase call spreads (debit spreads). You have to sell premium in this environment.

Once we get the bounce, option implied volatilities will decline. The market will retest support and the second bounce will set us up for call purchases. That might take a couple of weeks and the premiums will be more reasonable.

Make sure to watch the video I recorded last night.

This deep selloff tells me that trouble lies ahead. We will see two-sided price action and we won't be leaning on the uptrend is much. The market is likely to trade in a wide range in coming months and it will visit both extremes.

The market will rally early and probe for support. That dip needs to be brief and the market needs to march higher (no looking back). If I see buying into the closing bell, I will sell some out of the money put credit spreads. If not, I will stay sidelined.

I did sell a few put spreads yesterday on retail stocks and they held up well. The holiday season and lower gas prices will help the sector.

I also day traded from the short side once we made a new low for the day in the last hour. I will do the same today if it happens again.

Scale out of put positions and wait for the bounce.

.

.

Daily Bulletin Continues...