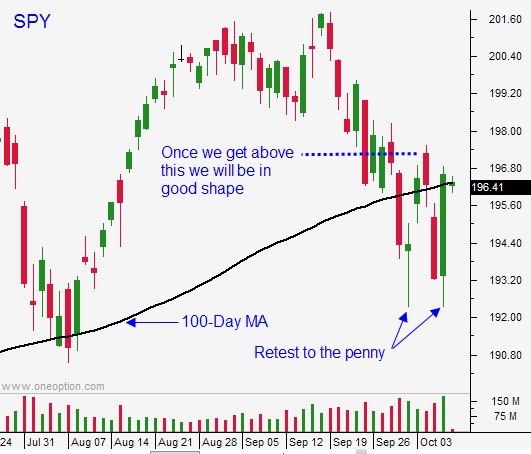

Market Will Test the 200-Day MA – We Should Bounce Quickly – If Not – More Selling Ahead

Posted 10:15 AM - If you want intraday comments, consider getting my trading platform ($60/quarter). I have been updating users during these crazy moves.

CLICK HERE TO LEARN MORE

Yesterday we saw another huge reversal. Volatility has picked up and we can expect a wild day.

Thursday I exited my call position when I was still profitable for the week and I consider myself lucky. As I mentioned in yesterday's comments, I was not going to let this trade slip away from me. The selling pressure is much heavier than I thought.

Now that we have a new closing low, the market will test the 200-day moving average. I don't believe we will spend much time at that level. Asset Managers will bid for stocks when we get close. We should see an intraday reversal off of that level and I will sell out of the money put credit spreads when I see it. Option implied volatilities are elevated and I can distance myself from the action. We will likely see an aftershock and a second bounce. That is the one we want to buy. In essence, we have to go through this process again.

So here's what we've learned.

This is more than bullish speculators getting flushed out. They exited call positions early in the week and we should have seen a nice rebound. In the last two years, 100-day MA breaches have quickly snapped back. The selling pressure we are seeing now is institutional.

The bottoming process is going to take longer than normal and the year-end rally might not challenge the high. We know that some Asset Managers are rotating out of equities and the selling pressure will increase when we get back to SPY $200.

We've also learned that the ECB is out of bullets. Europe will have to go through a recession without any life-support. Germany has been reluctant to consider fiscal stimulus and we'll see if they change their mind.

The Fed is worried about disinflation. They will remain accommodative and the phrase "considerable time" should remain in the October FOMC statement.

Earnings season kicked off and Alcoa posted strong numbers. Wells Fargo, Citigroup and J.P. Morgan will post results on Tuesday. The Financial Times surveyed bank executives and they expected excellent profits. They should set the tone for the market.

Interest rates are at historic lows and we've seen a flight to safety (bond rally). US equities are still the best place to be.

US corporations are buying back stock at a record pace and that will keep a bid to the market. Seasonal strength will help.

There are two potential rally killers, credit concerns and an Ebola outbreak. If economic conditions in Europe deteriorate quickly, credit concerns could escalate. The next time around, Mario Draghi's lip service won't work. I pray that we can contain Ebola. These will take time to manifest and I don't believe they will be an issue for the next few weeks.

If economic conditions in Europe deteriorate quickly, credit could become a problem. The next time around, Mario Draghi's lip service won't work.

I am going to day trade until we see a capitulation low. Once the market establishes its momentum, we continue in that direction the rest of the day.

Look for a probe down to the 200-day moving average. Watch for an immediate bounce. If we don't see it and we spend a considerable amount of time there, it means that the selling pressure remains heavy.

If you are long puts, set your target at the 200-day moving average. Option implied volatilities will be very high and you can get out at a great price.

.

.

Daily Bulletin Continues...