Market Stability Early In the Week – Flash PMIs Will Be A Speed Bump – Dip Likely

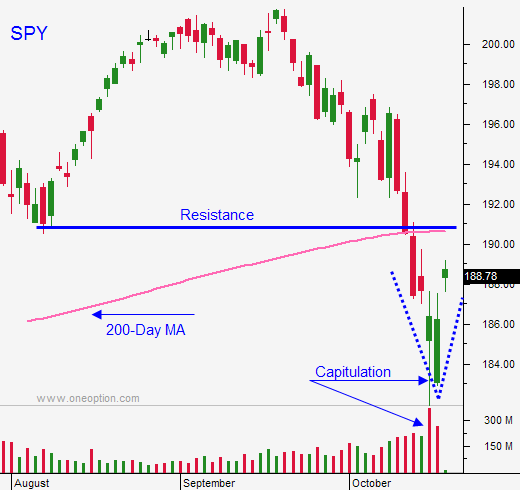

Posted 10:00 AM ET - Last week we saw heavy selling and the SPY fell below the 200-day moving average. We haven't seen this type of technical damage in more than a year and the bottoming process is going to take longer than normal.

Fortunately, buyers emerged Wednesday and the market closed above the open. The price action was weak Thursday morning, but buyers supported the market before it got down to Wednesday's low. On Friday, we saw follow-through buying. These are positive signs, but we are not out of the woods yet.

Earnings season will kick into high gear this week. The results will be good, but the guidance will be more important than the number. We need to hear that consumers are spending and I doubt we will. Last week, retail sales declined .3%. Low gas prices are not providing the stimulus we had hoped for. A strong dollar could also hurt earnings in Q3.

China will post GDP, industrial production and retail sales tonight. Their numbers have been in line recently and we should see similar. They will not spark a rally, but they could stop the bleeding if they are in line. A neutral number will put greater importance on the flash PMI's this Thursday.

All eyes will be on Europe. Traders will be scrutinizing Germany's economy. To the dismay of other EU members, they are not entertaining fiscal stimulus. The ECB said that it is out of bullets and Europe might have to go through a normal economic decline without any artificial support. This scares the heck out of investors. PIIGS bond yields are moving higher and credit issues could surface in 2015.

Three Ebola healthcare workers were released from quarantine this weekend. That will calm Ebola concerns.

During the first wave of panic selling, margin calls were generated and we saw forced liquidation. Option expiration also forced traders to adjust positions. Both events accentuated the market decline last week and the next sell-off should be much more orderly.

I sold a few put spreads last Friday when the market pulled back from its high. I like selling put spreads after earnings announcements and I will have more to choose from in a few days. My risk exposure is very small and most of my activity is limited to day trading. This is a momentum driven market and I like day trading based on the range the first hour. If we are above it, I trade from the long side. If we are below the one hour range, I sell short. I have been using my scanner/1OSystem combination to find trades and I posted a video in last Friday's comments.

Option implied volatilities are declining and that is good. We want some of the "juice" to come out before we buy calls. When we do get the second decline, premiums should be cheaper. I'm expecting a more orderly decline and the S&P should make a higher low. Premiums should not "pop" and we will be able to buy calls on the next bounce.

This forecast assumes that we will not have any new Ebola outbreaks in the next few weeks. If that happens, all bets are off. This killer has the potential to spread and to destroy economic activity. Let's pray that we can contain it and treat it.

If the only headwind is European economic activity, I believe the market will be able to find support. Credit concerns should remain subdued the rest of the year and we should see a year-end rally that gets us back to the 100-day moving average.

Look for companies that are reporting strong earnings. Put them in a watch list and monitor how they respond during market weakness. If they hold up well, they will run we get the second bounce.

Look for stability early in the week and a negative reaction to the PMI's.

.

.

Daily Bulletin Continues...