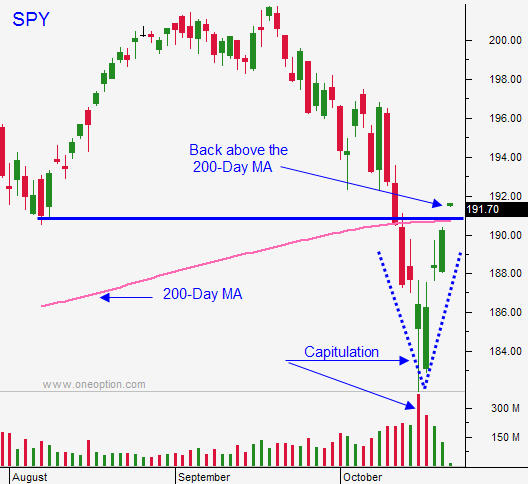

S&P Is Above the 200-Day MA. We Will Test It Early – If It Holds – Buy Some Call Options

Posted 9:45 AM - Yesterday, we saw nice round of follow-through buying. The capitulation low was established Wednesday and we tested that low on the open Thursday. Since then, the price action has been bullish.

Apple posted better than expected results and that will help. The S&P futures were up 15 points a few hours before the open and now they are only up 8 points. Some of the earnings reactions this morning (Coke, McDonald's and Verizon) were negative. These are all Dow components and after IBM's dismal results, this index could lag.

The S&P 500 is above the 200-day moving average. I believe we will test it early in the day. If it holds, I will trade from the long side and I will buy a few calls. I have been able to catch most of the moves day trading so I'm not overly anxious to carry an overnight position. If this plays out and I buy calls, I will sell at least half of them before the close Wednesday.

Flash PMI's will be posted Thursday morning and I believe weakness in Europe will spark a round of selling. Their economic conditions continue to deteriorate and Germany is opposed to fiscal stimulus. The EU will have to go through this economic cycle without artificial support. The ECB is out of bullets and this has investors spooked.

China posted better-than-expected results last night. GDP grew 7.3%, industrial production hit 8% and retail sales were in line. These were a good numbers and they will attract buyers today.

Yahoo and VMware announce after the close. A slew of large-cap stocks will post before the open tomorrow and we will have an excellent sampling across all groups.

Ebola fears are subsiding. Three healthcare workers were able to leave quarantine yesterday and there have not been any new cases. This wildcard could flare-up at any moment so caution is warranted.

Last week's decline was influenced by option expiration and forced liquidations due to margin calls. These two events ran their course and any future decline should be more orderly.

Given the depth of last week's decline, I believe this bottoming process will take time.

If you are a short-term trader, buy some calls today and use the 200-day moving average as your stop.

If you are a swing trader, sell some out of the money put credit spreads on stocks that have posted strong results. Distance yourself from the action and wait until the flash PMI's are released Thursday morning. If the numbers are good (unlikely), you will have to buy into strength, but your put spreads will be working in your favor. You will also know that support at the 200-Day MA is solid.

If the numbers are weak and the market pulls back, you will have a better entry point for your call purchases.

I have been very aggressive buying the dips below the 100-day moving average the last two years. I sense that conditions are changing and I am more passive this time around.

The market should probe for support early. As long as the 200-day moving average holds, we will bounce and grind higher the rest of the day.

.

.

Daily Bulletin Continues...