Bottoming Process Will Take Time – Don’t Worry – You Will Get Another Chance To Buy

Posted 10:45 AM ET - I recorded this video last night. This is how I have been day trading this bounce. These trades took me 3 minutes to find

CLICK HERE TO WATCH THE VIDEO

Yesterday, the market opened on a weak note. It quickly found support above Wednesday's low and we rallied the rest of the day. I mentioned that the close would be critical and we finished near the higher the day. This morning, the market opened with a bang and we continue to grind higher. These are all positive signs.

Before you get too excited, realize that the tone has changed in the last few weeks. Europe continues to weaken and Germany refuses to consider fiscal spending. Greek yields spiked and credit concerns are rising. Ebola is far from being contained and the situation will get worse.

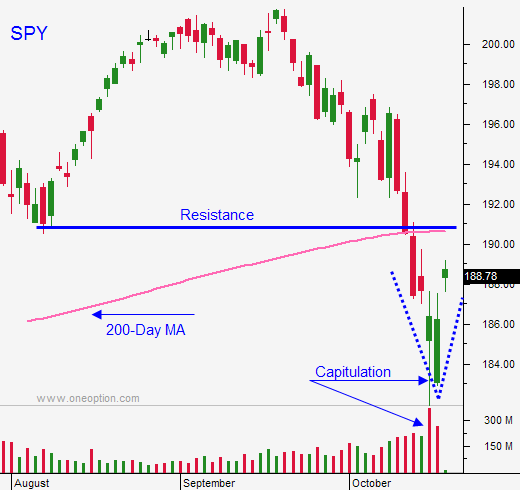

The decline was sparked by panic, but it was fueled by margin calls and option expiration. I mentioned yesterday that the last two events had run their course and that based on this alone, prices should stabilize. I also mentioned that earnings season would take the focus off of Ebola and that would also help.

Earnings have been good, but the strong dollar is creating a bit of a headwind. Retail sales fell .3% this week and consumers are still cautious.

China will post major economic releases Monday night (GDP, retail sales and industrial production). Any signs of weakness will weigh heavily on the market.

This bottoming process will take time. One new Ebola case or a bad economic release from Europe will send this market right back down to support.

We have been in a five-year bull market and it will die hard. That means that violent snapback rallies will be common.

I urged you to take profits on your put positions throughout the week and if you followed my advice, you're going to have a great weekend. This is why I like to scale out. It is impossible to time the perfect exit. Anyone holding onto puts is feeling the wrath of an implied volatility collapse today.

I have been day trading stocks this morning. I am using my one option system in conjunction with my scanner to find candidates. To learn more, watch the video at the beginning of my comments.

I will not be selling any put credit spreads today. I was hoping for an early retracement, but I didn't get one. I am not going to sweat this because I'm confident that another dip is looming. Depending on how far option implied volatilities fall, I might be more inclined to buy calls when it happens.

The second mouse gets the cheese. Be patient and wait for the next opportunity to get long.

.

.

Daily Bulletin Continues...