Market Will Hit A Speed Bump – Flash PMIs In Europe Will Be Weak – Take Profits On Calls

Posted 9:45 AM ET - My system caught the decline and the bounce. I recorded this video yesterday and it includes SPY, DIA, IWM, QQQ, GLD and TLT

CLICK HERE TO VIEW IT

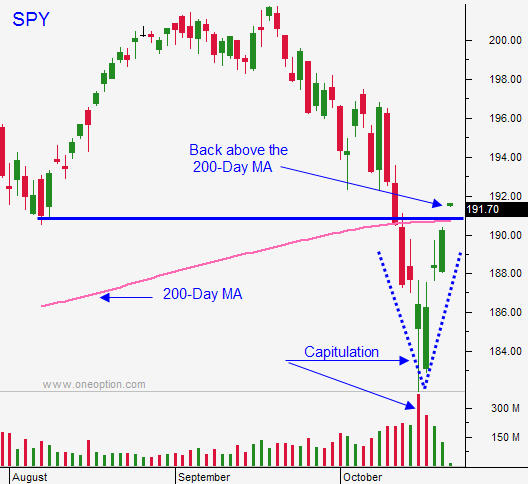

Yesterday, the market surged higher and the S&P 500 blew right through the 200-day moving average. We did not probe for support and stocks immediately marched higher. The overnight news was light and the S&P 500 is holding Tuesday's gains.

I have been day trading S&P Eminis and I've been able to catch most of the move without taking overnight risk. This tactic is working well and I will stick to it. As I outlined yesterday, I also bought calls early in the day when the momentum was set. I hit my target profits and I sold half of the position before the close. I will sell the other half today.

I believe we will hit a speed bump tomorrow. The market has run back very quickly and the flash PMI's in Europe will be bearish. I believe the S&P 500 will pull back to the 200-day moving average in the next few days. That support should hold and we will stage the next leg of this rally.

Earnings releases have been decent. A strong dollar is providing a bit of a headwind. Now that more companies have reported, I will get more aggressive with my put credit spreads.

European banks will report stress tests and 11 out of 130 are expected to fail. The ECB might start buying corporate bonds and this QE rumor fueled the rally yesterday.

The PBOC does not have any easing plans. Their GDP, industrial production and retail sales were slightly better-than-expected.

I suggest exiting any call positions today. If you bought this rally, you have fantastic profits.

I will not sell any put credit spreads until the flash PMI's have been released. I want to see the reaction.

Look for companies that exceeded earnings and revenue estimates. Ideally, they raised or reaffirmed guidance. Make sure that there is technical support between the short strike price and the stock price. If support is breached, buy back the spread.

I suggest playing a little safe today. I will day trade based on the range the first hour. If we are below it, I will trade from the short side and I am likely to sell my calls. If we are above the high established in the first hour, I will trade from the long side. I've been able to capture most of the move daytrading and I will continue to use this tactic.

Once we get the pullback and the market establishes a higher low, I will feel more confident buying calls. Especially if the 200 day moving average holds.

.

.

Daily Bulletin Continues...