Flash PMIs Were Better Than Feared – Market Likes the News – Sell Put Spreads

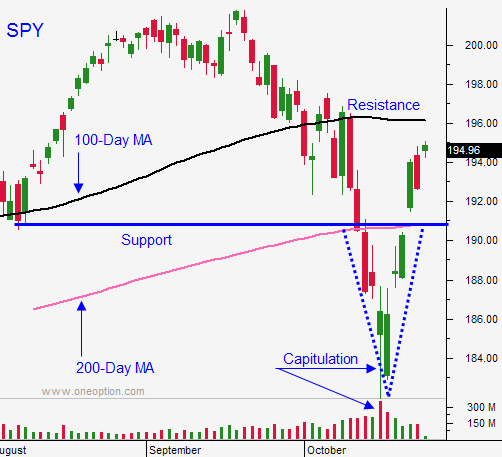

Posted 10:15 MA ET - Yesterday, the market hit resistance and traders sold ahead of the flash PMI's. The numbers out of Europe were better than feared this morning and stocks are trading higher.

Flash PMI's in Germany ticked higher. The news was not great, but economic activity is not falling off of a cliff. This was one of the major market concerns since Germany is opposed to fiscal stimulus. This dark cloud has temporarily parted.

Ebola concerns are also subsiding. There have not been any new cases in the US and the quarantine for healthcare workers will end soon.

Earnings have been decent. The strong US dollar is providing a small headwind.

Consumers are cautious and retail sales have been light. Lower gasoline prices are not providing the relief everyone was expecting.

The Fed will end its bond purchase program and it is scheduled to meet next week. They will not remove the phrase "considerable time" until December. Disinflation fears will keep them accommodative.

The S&P 500 is only 25 points from the 100-day moving average. That will provide some overhead resistance and I doubt we poke through it on the first attempt.

I like the news today and I like the backdrop. My only concern is that the market has rallied too far, too fast.

I am selling out of the money put credit spreads on stocks that have announced strong earnings. I make sure that there is technical support between the stock price and the short strike price. If technical support is breached, I buy back the spread. These are low maintenance trades.

As far as taking long positions, I want to see how the first hour plays out. If the market is able to hold on to the early gains and grind higher, I will buy some S&P futures for a day trade. If we continue to grind higher this afternoon, I will buy some calls. I am not getting overly aggressive with my call purchases.

I have been able to catch most of the moves intraday trading S&P Eminis. Yesterday, I told you that I would short the S&P Eminis if the low from the first hour of trading was breached. That short worked out very nicely and I exited the position near the close.

I will use the same tactic today, but I think the market will hold up pretty well today.

Regardless, I want to sell put credit spreads. I believe the 200-Day MA will hold on the SPY. That means my downside is relatively contained.

We could chop around for a few days and consolidate gains from the bounce. Ultimately, I believe we will start moving higher after a few days of rest.

If you are a swing trader, sell some put credit spreads today. If we pullback, don't buy calls. If we grind higher throughout the day, buy a few calls.

.

.

Daily Bulletin Continues...