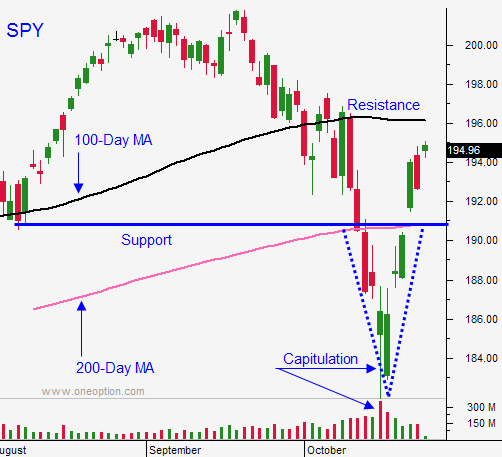

S&P Touches the 100-Day MA – Market Needs To Consolidate – Sell Put Spreads

Posted 9:30 AM ET - Yesterday, the S&P 500 rallied right up to the 100-day moving average and it hit resistance. We've rallied more than 100 points in the last week and this bounce might be getting a little tired.

New York City has its first Ebola case and the S&P 500 was down 10 points a few hours ago. It has gradually clawed its way back and officials believe they have it under control. Ebola will get worse before it gets better and we can expect shocks like this.

European bank stress test results will be released this weekend. Analysts are expecting 11 failures out of 130 banks. This news is priced in. If there are more than 11 banks in trouble, the reaction could be a little negative.

Amazon missed its number yesterday and the stock is down $30. The Fire Phone did not sell as well as expected.

Earnings have been good this quarter. A strong US dollar is providing a bit of a headwind. Lower gasoline prices were supposed to spark consumer spending, but retail sales have been soft.

The FOMC will meet next week and I'm expecting them to keep the phrase "considerable time" in their statement. They are worried about disinflation and they want to remain accommodative. The Fed will end its bond purchase program and they don't want to hit the market with a double whammy. Leaving the phrase in should spark a rally.

The November elections will be held a week from Tuesday. Analysts believe there is a 75% chance that the GOP will win six seats and take control of the Senate. We could see a small rally into the elections.

The jobs report will be out for another two weeks. Initial jobless claims have been excellent the last few weeks and we should see strong employment numbers.

China's GDP, IP, retail sales and flash PMI's were good. EU flash PMI's were better than feared and Germany’s economy is not falling off of a cliff.

Apart from Ebola, the biggest negative is the magnitude of this bounce. I believe the market needs time to consolidate. If we start to drift lower, we are likely to find support above the 200-day moving average. I believe that any dip will be a buying opportunity.

I have been selling out of the money put credit spreads on strong stocks after they post earnings. I make sure that I have technical support between the stock price and the short strike price. If support is breached, I buy back the spread. This strategy allows me to distance myself from the action and it takes advantage of time decay.

I have also been trading the S&P emini based on the one hour range. If the market is above the one hour range, I trade from the long side. If the market is below the one hour range, I trade from the short side. This simple tactic has worked well the last few weeks and it is ideal for momentum driven environments. I have been able to catch most of the moves without taking overnight positions.

I am not buying options at this time. I still want some of this volatility to dissipate and that might take another week. Margin calls (forced liquidation) and option expiration accentuated last week's freefall. Those two events played out and we should not see any violent moves like that the rest of the year. If we get a dip in the next few days, I will start buying calls once support has been established.

Look for opportunities to sell put credit spreads.

The market looks a little fragile today and we could probe for support.

.

.

Daily Bulletin Continues...