The Market Bounce Is Over Extended – A New Ebola Case In NY Will Spark Selling

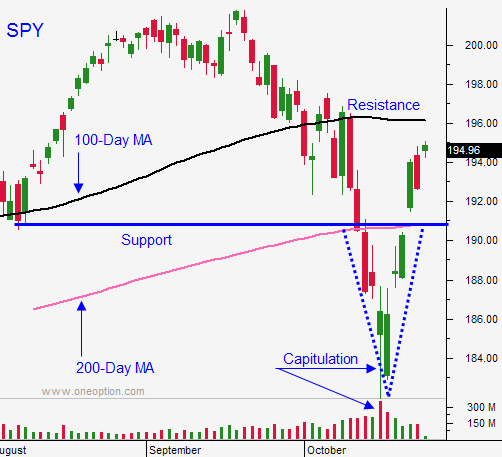

Posted 9:50 AM ET - Last week, the market rebounded sharply and we closed above the 100-day moving average on Friday. This bounce is overextended and we could see some profit-taking today. A new Ebola case in New York City has investors spooked.

It is impossible to predict the amount of fear that this deadly disease can generate. All I can say is that it will probably get worse before it gets better.

The rest of the macro puzzle pieces are in place for a year-end rally.

Economic conditions in Europe are slipping, but they are not falling off of a cliff. We've had to deal with slow growth in Europe for the last few years. The flash PMI's last week were a little better than feared and so were the bank stress tests.

China's economic growth has been stable at 7.5%. Their GDP, industrial production, retail sales and flash PMI's were better-than-expected last week.

The FOMC statement will be released Wednesday. The Fed will end the bond purchase program, but they will remain accommodative. They are aware of slow growth in Europe and global disinflation and they will keep “considerable time” in the statement.

Earnings have been good and corporations are buying back shares at a record pace. This means that there is a strong underlying bid to the market.

Interest rates are near historic lows and US equities are still the best game in town.

The market bounce is over-extended and I am expecting a pullback. We should find support above the 200-day moving average. This dip will present a buying opportunity.

The November elections will be held a week from Tuesday. Many analysts believe that Republicans will take back the Senate and we could see a small GOP rally. ADP will be released a week from Wednesday and the results should be good. Initial jobless claims have been low the last few weeks.

I am selling out of the money put credit spreads. This strategy allows me to distance myself from the action. I am focusing on stocks that have posted strong earnings and that are rallying after the news. I lean on a technical support level between the short strike price and the stock price. If that support level is breached, I buy back the spread.

I have also been trading the S&P. Once the first hour range is established, I buy if we are above it and I short if we are below it. This tactic works when the intraday momentum is strong. I've been able to catch almost every major move in the last two weeks using this tactic.

I still don't want to buy calls. I feel that we will pullback at some point.

The SPY is below the 100-day moving average and it should provide some resistance. Look for choppy trading with a negative bias today. Let's see if this opening decline can gain some traction.

.

.

Daily Bulletin Continues...