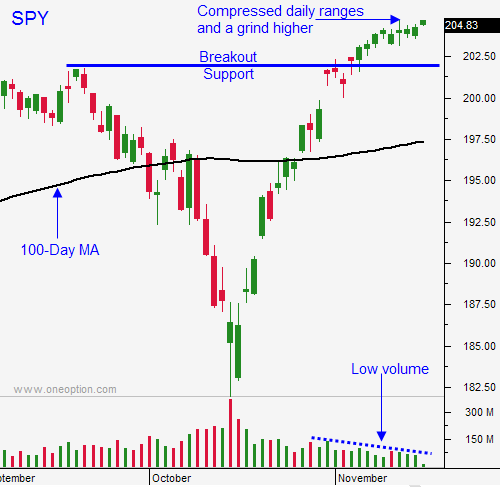

Market Will Drift Higher On Light Volume – Seasonal Strength and A Light Calendar Favors the Bulls

Posted 9:40 AM ET - Sometimes you just have to make the best of the situation. I have my skis tuned and I'm ready to go. I'm sure wherever you live, it is cold.

You can tell from my introduction that there's not much to write about. Trading volumes are at their lowest level of the year and the week of Thanksgiving is typically very slow.

Japan's GDP declined 1.6% when most analysts were expecting a 2.2% increase. Their market dropped on the news and it had a temporary impact on global markets Monday. Today, the Nikkei is rebounding on the notion that tax hikes will be delayed.

As I mentioned in my comments, dips will be brief and shallow. Asset Managers want to get long into year-end and profit-taking is minimal.

The FOMC minutes will be released tomorrow afternoon. The Fed's tone was a bit more hawkish, but the market was falling apart during the meeting and I believe the comments were tempered. This release should not have a major market impact - the next meeting is in December.

Flash PMI's will be released on Thursday. Strength in the US and China will offset weakness in Europe. As long as Germany is stable, this market rally will continue.

Oil prices are falling and that is good for consumption. Retail sales increased .3% and that was better than expected. The retail sector has been performing well after earnings announcements.

The calendar is light and that favors the Bulls. Seasonal strength will push the market higher on light volume.

I am long in the money December calls that have a high Delta. My risk exposure is 35% of my normal trade size and I am rotating in and out of stocks as they lose momentum. I don't like getting long at an all-time high so I will not increase my exposure.

Look for stocks that have been in an uptrend, have consolidated and are breaking through horizontal resistance. If you're using my trading system, look for recent buy signals as well.

This week I bought back my November put credit spreads and I sold December put credit spreads (rolled out). This allowed me to lock in profits and to get some trades working for December.

The S&P has been trading in a tight daily range - I am not day trading Eminis. The market momentum has stalled.

Look for quiet trading with an upward bias. The market has established a pattern of early weakness and late strength. That is bullish.

Raise your stop to $203.50 on a closing basis. If the stop is hit, we will make money. If we are not stopped out, we will keep riding the wave and raising our stop.

.

.

Daily Bulletin Continues...