News Is Light and Volume Is Thin – Look For Choppy Trading With an Upward Bias This Week

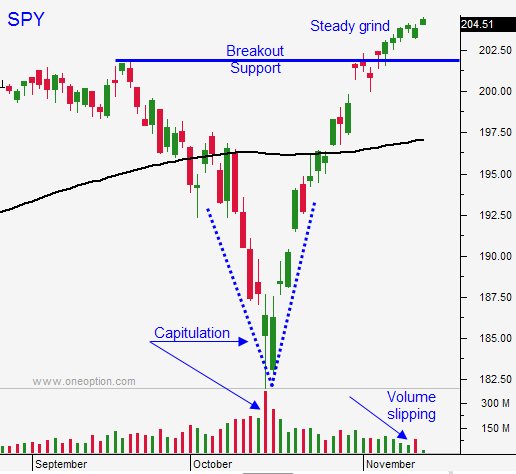

Posted 9:40 AM ET - Over the weekend Japan posted a much weaker than expected GDP (-1.6% versus 2.2% expected). No one was expecting a negative print and this comes on the heels of a 7.6% decline last quarter. Selling in Asia spilled over to Europe this morning and the S&P 500 is down five points before the open. The upward momentum has stalled and the market is resting after a huge run.

Bullish speculators have been piling in and we could see some small pullbacks to shake them out. Any dip will be brief and shallow.

Last week, global economic releases were decent. EU GDP's were better than feared and industrial production and retail sales in China were in line.

Domestic economic releases have been strong. GDP, ISM's and employment have all been solid. Last week, retail sales were up .3% and that was better than expected.

Retailers will dominate the earnings scene this week. Profits have been good, but top line growth is slim. In many cases, companies lowered guidance, but the stocks still rallied after posting results. This sector should do well into the holiday season.

Thanksgiving is 10 days away, but traders are already looking ahead. The news releases are very light this week and the volume will dry up. The FOMC minutes Wednesday afternoon and flash PMI's Thursday morning are the only significant releases this week. I am not expecting any surprises from either event. Thanksgiving week is typically bullish, but very quiet.

Daily trading ranges have collapsed. Consequently, I am not day trading the S&P futures.

My put credit spreads are in great shape and I am buying them back for pennies. This will release margin and I can roll the positions out to December.

I am long in the money call options with high delta's (35% of my normal position). I'm looking for stocks that are breaking through horizontal resistance after a period of consolidation and that have recently triggered a buy signal on my system. These stocks typically take off right away and the moves are sustained for 3 to 5 days. If I don't get the move, I exit. Once the momentum stalls, I started scaling out of the position and I move on to the next candidate. I am not increasing my risk exposure; I am simply rotating in and out of stocks. In the money calls with high deltas are not very exposed to time decay and they move point for point with the underlying stock. This allows me to take profits along the way.

My overnight exposure is fairly small. As I've been telling you for the last week, I hate getting long at an all-time high. I have been moving my stops up and if they get hit, I will still exit at a profit.

Trading volumes are very light. We will probe for support early today and a light round of profit-taking will test the bid. Some bullish speculators might get nervous, but the damage should be relatively contained.

Dips will be brief and shallow.

Raise your stop to SPY $203 on a closing basis.

.

.

Daily Bulletin Continues...