Let’s Find Some Trades – Free Webinar Tonight – Market Will Grind Higher

Posted 9:30 AM ET - I will be hosting a FREE webinar tonight. I will find at least 4-5 new trades. I will also take symbol requests to see how my system has performed on your stocks.

CLICK HERE TO REGISTER

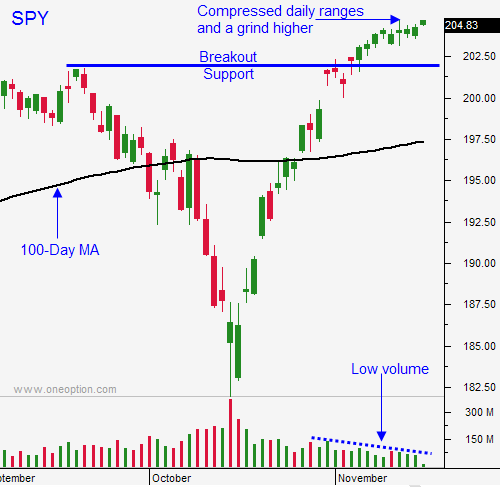

The market tested the downside briefly on Monday and it rebounded instantly. That was a sign that the bid was strong and stocks pushed higher yesterday. The SPY is marching ahead and we are making new all-time highs on a daily basis.

The FOMC minutes will be released this afternoon. During their last meeting, the market was tanking. I believe the comments will be tempered even though the overall tone was more hawkish. This is one of the only significant news releases this week and it could spark a little activity. If we dip on the news, the selling will quickly abate.

Tomorrow, flash PMI's will be posted. Bad news is priced in for Europe and that means we could get a little bit of an upside surprise if conditions are stable. Germany seems to have stabilized and their GDP number was better than feared (.1%). Activity in the US and China should be good.

Thanksgiving will strip three trading days out of next week. Many traders will take Wednesday off and it is a travel day for many people. The activity will be slow. Trading volumes are at their lowest level this year.

The macro backdrop is bullish. No one is going to stand in front of this light volume rally when we are making new all-time highs. Even a small bid can push stocks higher.

The Keystone pipeline missed approval by one vote. That could be a slight negative, but Congress will try again. Obama is going to ram through his immigration agenda and that could raise tempers in DC.

Corporate earnings have been strong, interest rates are near historic lows, corporations are buying back stock at a record pace, Ebola outbreaks are declining and central banks are printing money like mad. These are all bullish influences.

We have seen early weakness and late strength each day. That is a bullish pattern.

Light news and seasonal strength favor the bulls.

Look for a choppy grind higher on low volume.

You should have excellent profits, manage them. I am moving my stop up to SPY $204 on a closing basis. If it gets hit, I will lock in profits. If not, I will continue to ride this wave.

.

.

Daily Bulletin Continues...