Lots of New Trades – Watch Last Night’s Webinar – Market Will Test Bulls Today – Raise Stops

Posted 9:20 AM ET - Last night I hosted a webinar and I found a bunch of new trades.

CLICK HERE TO WATCH

The market was in negative territory the entire day Wednesday, but it did manage to claw its way back. We have seen a pattern of early weakness and late strength. That is bullish and we want to see it continue.

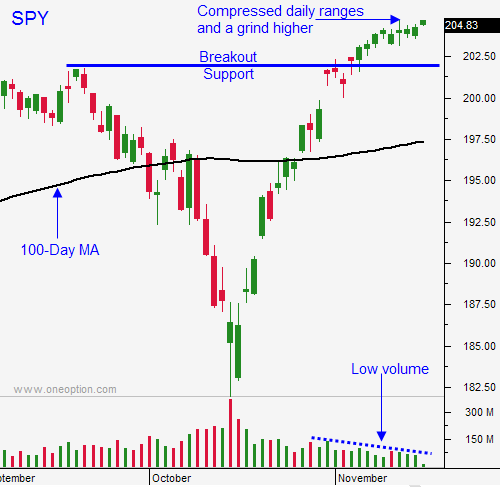

I don't trust light volume rallies especially at an all-time high. That is why I've kept my size relatively small and why I've been raising my stop. If it gets hit today, I will take profits and I will wait for support. If SPY $204 holds on a closing basis, I will continue to ride this wave.

Not much has changed, but we are seeing a little option expiration volatility. The FOMC minutes were benign. The Keystone pipeline missed approval by one vote and Obama will push through his immigration agenda today. The last two events are weighing on the market, but they won't spoil a year-end rally.

Flash PMI's were little weaker than expected. Europe came in at 51.4 when 52.3 was expected. China came in at 50 and 50.2 was expected. Durable goods orders and GDP are the only significant releases next week and neither should have a market impact.

We are going to see a little profit-taking today and bullish speculators will be tested. The macro backdrop is still bullish and this is nothing more than a dip.

Light news and seasonal strength still favors the bulls. Yesterday I listed a number of bullish influences and they are all intact.

I'm not remotely concerned about my bullish put spreads. They are out of the money and I have plenty of room to whether a small pullback. If I get shaken out of my calls, I will lock in profits. I would like to reload at SPY $202 and I'm expecting that breakout to hold.

Ideally, we will probe for support early this morning and we will rally late in the day and close above $204. That will give us a little breathing room and we will try to stay long.

It the selling continues late in the day and we are below our stop, we will know that it's time to get out.

Use SPY $204 as you stop on a closing basis.

.

.

Daily Bulletin Continues...