Market Spikes To A New High – The Punch Bowl Is Overflowing – Take Some Profits!

Posted 9:30 AM ET - Last night I hosted a webinar Wednesday and I found a bunch of new trades.

CLICK HERE TO WATCH

The punch bowl is overflowing. Draghi is rambling about additional QE, Japan launched a massive QE program two weeks ago, the Fed kept "considerable time" in its statement and today the PBOC lowered rates for the first time in two years. The S&P 500 is up 18 points before the open.

Before we get too excited, we have to ask ourselves why all of this liquidity is being injected into the financial system. Europe and Japan are on the brink of a recession. Germany's GDP rose .1% and Japan's GDP fell 1.6% (analysts were expecting 2.2% growth). Banks in China are experiencing a cash crunch. This liquidity injection will ease that situation.

This is good news for the market, but we have to be aware that economic conditions are fragile. This is a house of cards. I'm going to ride the wave as long as I can, but I am prepared to bail at a moment’s notice.

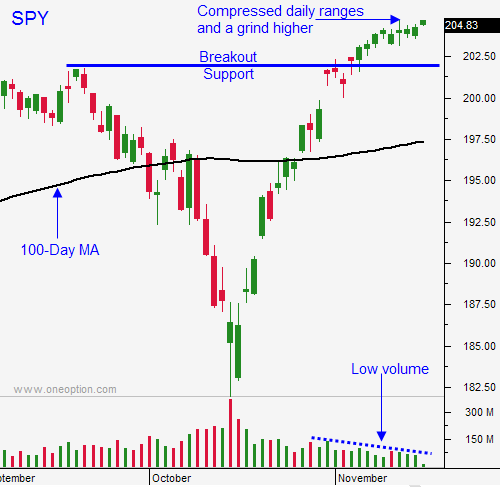

I've been telling you that we don't want any big spikes. That will attract profit-taking and we could see selling and increased volatility if the market gets ahead of itself.

Today is option expiration. Anyone who is short calls will be scrambling to buy them back. This will fuel the rally and the move will be exaggerated.

I am very happy with my profits, and I will be taking some chips off of the table today. I will sell one third of my calls (35% of my maximum size) today. That will make the remaining position easier to manage and I won't feel like a pig.

The news next week is light and Thanksgiving will reduce activity. Durable goods orders and GDP won't have much of an impact.

Yesterday's early dip did not last more than a few minutes. Buyers instantly stepped in and the market finished strong.

I am still bullish, but I want to be prudent. Raise your stop to SPY $206. If it is hit, you will lock in hefty profits.

I plan to ride this wave as long as I can. I will set targets and scale out.

Look for an explosive opening move that gradually fades. I expect to see the highs of the day in the first hour. This is options expiration and we are likely to see some selling late.

.

.

Daily Bulletin Continues...