Market Will Rally Into Black Friday – Set Targets and Take Profits This Week

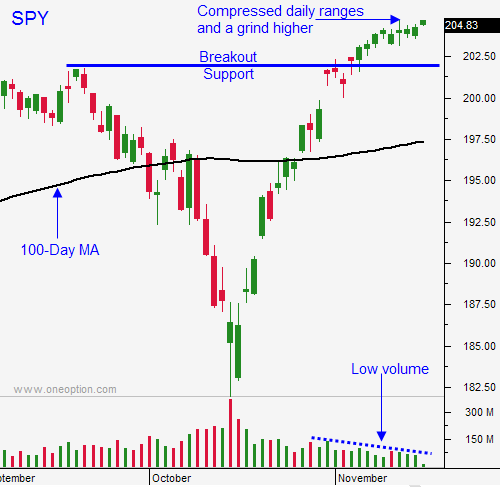

Posted 9:30 AM ET - Last week the market surged higher. The People's Bank of China filled the "punch bowl" and option expiration fueled the rally. This rally is getting a little overextended and I am taking profits along the way.

Do you think that it is a coincidence that central banks announce major moves on Thursday? They know that option expiration will provide an extra "kicker" and they time the release. The Bank of Japan made a similar move during October option expiration. The Fed was notorious for doing this during the 2009 crash. Options that look like they will expire worthless on the eve of expiration are all the sudden in the money and shorts scramble to cover.

The ECB, the BOJ and the PBOC have all eased substantially in the last month. Central banks are racing to devalue their currencies and the market loves the news.

Unfortunately, these moves are a sign of weakness. Europe is trying to avoid a recession and Germany's GDP grew .1% last quarter. It is the EU cornerstone. Japan's GDP declined 1.6% when analysts were expecting 2.2% growth. Their current stimulus plan is not resulting in growth. China lowered rates for the first time in two years to head off a cash crunch. Banks needed the extra liquidity heading into the holiday season.

The news this week will be very light. GDP tomorrow and durable goods on Wednesday won't have much of an impact.

Easy money and seasonal strength will fuel the rally this week. Traders will take time off and the volume will be light.

The market tends to rally into Black Friday and it tends to selloff on Cyber Monday. I plan to scale out of my call positions by Friday's close.

I took profits on one third of my call positions last Friday and I am down to 20% of my maximum position. I locked-in fantastic profits and I'm happy.

My put credit spreads are in great shape. They are safely out of harm's way and they are leaking oil (time decay) every day.

Asset Managers are anxious to get in, but they won't chase at an all-time high. The market has had a fantastic run and the higher we climb, the greater the chance for profit-taking. I can't help but think that I will have another opportunity to get back in at a better level. Bullish speculators are ripe to get flushed out.

I will eat more than I should this Thursday, but I won't be a glutton when it comes to my trading.

Raise your stop to SPY $206 and set targets. Take profits along the way and sell into strength.

I'm not bearish, I am just being prudent.

.

.

Daily Bulletin Continues...