FOMC Rally Would Be Temporary – Market Needs To Probe For Support and Capitulate

Posted 10:00 AM ET - I am hosting a webinar tonight. I will use my trading system to find new trades

CLICK HERE TO REGISTER

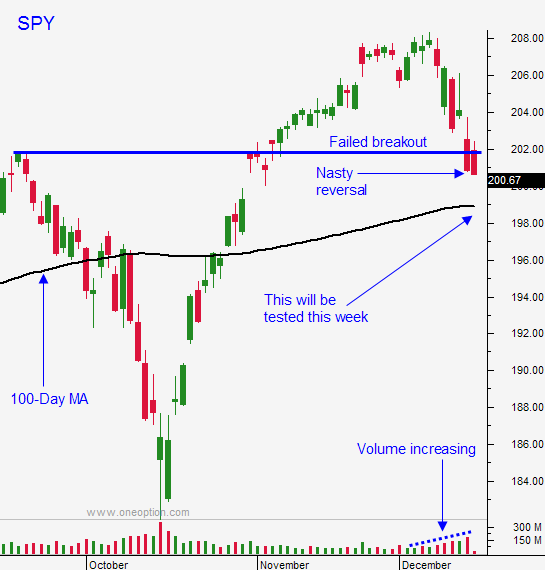

Yesterday, my call for an air pocket looked pretty foolish after a few hours of trading. The S&P 500 rallied from negative territory and it was up 24 points by mid-day. That was a 40 point swing and it looked like we were off to the races. Given all of the negative events, I can only justify it as short covering and option expiration volatility. Once the highs were established, we saw a steady wave of profit-taking.

The S&P 500 finished on its low of the day and it was below the 100-day moving average. I bought puts in the last hour of trading and I believe we will see more selling before the FOMC statement today. I will short S&P futures below the 100-day moving average today and I will use SPY $199 as my stop. I plan to exit all of my shorts before the FOMC statement.

If the market declines after the statement (I will not trade for the first 10 minutes) I will short the S&P 500. I will use the low of the day prior to the FOMC statement as my stop. I do not want to carry overnight short positions.

I bought puts yesterday because I thought we would see follow-through selling if we closed below the 100-day moving average. I also thought that the FOMC statement would weigh on the market today. I will not buy puts after the FOMC today for a few reasons. Option implied volatilities have spiked and I hate buying rich premium. The market has been extremely volatile intraday and I feel that I will be able to catch shorting opportunities using the futures intraday. Central banks like shocking the market on the eve of option expiration. This is happened the last two months (BOJ and PBOC) and if we see a steep decline, they might make a statement to stop the bleeding.

We will see nervous trading for about an hour and then the action will stall. After the FOMC statement, we will see a big move. I believe that "considerable time" will be removed, but the Fed will add dovish rhetoric to soften the blow. The market is already prepared for the phrase to be removed and I believe the reaction will have more to do with Russian credit concerns than anything else. If we selloff, the Fed will take the blame, but in reality, credit concerns are the greater issue. China's flash PMI was also weak and that could be a bearish influence.

If the Fed surprises us by leaving the phrase in, we will see a short covering rally. I don't believe it will last more than a few days. We still need to probe for support and I can't fully embrace a rally until I see an air pocket and a capitulation low.

Credit conditions in Russia are starting to take a toll. They raised interest rates to 17% in an effort to strengthen the ruble. So far, that tactic has not worked. Unlike most other countries, Russia does not have any allies. Putin has alienated the EU and the US. Unfortunately, global credit markets are intertwined and one domino could start a chain reaction.

Oil prices will stabilize in the next few weeks. Energy stocks have been weighing on the market and the rate of decline will slow. Many stocks in the sector are already forming a base and that means that their impact on the market will be diminished from this point on.

Consumer stocks and transportation stocks should start to benefit. Today FedEx reported a 20% jump in earnings. Volumes in the US were up 7%. The stock is down due to lofty expectations. It is considered an economic barometer and the news was good. Lower gas prices will help consumers and oil is a huge input cost for most companies.

Now that the 100-day moving average has been breached, we will probe deeper for support. I would like to see an air pocket that results in a capitulation low. That will present an opportunity to sell out of the money put credit spreads in January. The news will dry up next week and the market should find a bid.

Until then, I will be looking for intraday shorting opportunities.

If you are a nimble, follow the guidelines I presented above. You can lean on the 100-day moving average today.

.

.

Daily Bulletin Continues...