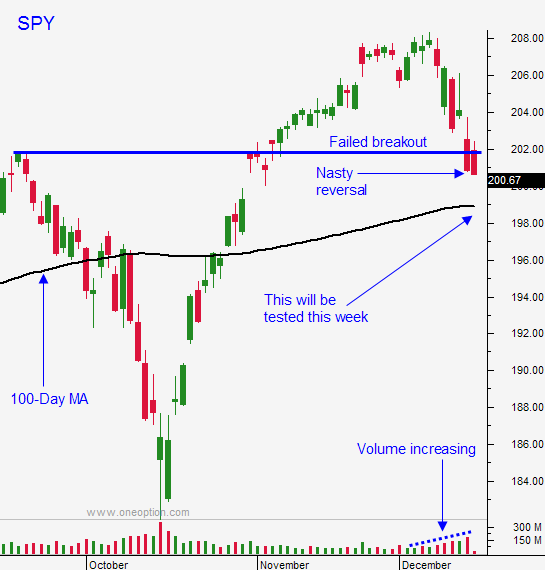

Market Breaching Major Support – Decline Will Get Worse – Air Pocket Possible Today

Posted 9:40 AM ET - Yesterday, the market staged an impressive rally early in the day. The S&P 500 was up 20 points and prices gradually slipped throughout the morning. The lows from Friday (SPY $200.80) were breached and stocks reversed sharply. This morning, the S&P is down 11 points before the open and it is challenging the 100- day moving average ($199).

In my comments yesterday, I mentioned that the early bounce Monday would allow me to gauge the strength of the bid. Obviously, there are more sellers than buyers.

Flash PMI's were released overnight and Europe was slightly better-than-expected. You know from my comments that I am more concerned with China. Their flash PMI dropped to 49.5 when 50.2 was expected. This is not a good sign. I suspected as much when the PBOC jumped into action a few weeks ago. I believe that it will be difficult for the market to rally now that economic activity in China can be questioned.

Low oil prices are creating a credit crisis in Russia. They raised interest rates to 17% in hopes of strengthening the ruble. Central banks around the world have been printing money like mad and one domino could set off a chain reaction.

The FOMC will meet tomorrow and they are likely to remove "considerable time" from their statement. The Fed sees the turmoil and they will soften the blow by adding new dovish comments.

The debt ceiling has been extended for another year and that is bullish. This news was already priced in.

Energy stocks have been pummeled and the rate of decline will slow. That means oil stocks won't way on the market is much as they have. Consumer discretionary stocks will catch a bid due to lower gasoline prices. Next to labor, oil is a huge input cost for most companies and this decline will improve margins.

Yesterday I bought back my remaining put credit spreads when Friday's low was breached. Overall, time decay and my hedges still yielded a profit. Now I am flat and I will be trading the short side from the opening bell today. I will use the 100-day moving average (SPY $199) as my entry and my stop.

There are enough negatives (Russian credit, FOMC, Greek elections and China's Flash PMI) to fuel this decline. If we close below SPY $199, I will buy a few puts (5% of my maximum position).

The fact that we can't rally into year-end is bearish.

Look for heavy selling and a possible air pocket today.

.

.

Daily Bulletin Continues...