Fed Leaves the Phrase In – Shorts Get Squeezed – Issues Still Loom – Don’t Chase

Posted 10:00 AM ET - Last night I hosted a webinar and we found at least 10 new trades that are setting up right now.

CLICK HERE TO WATCH THE WEBINAR RECORDING

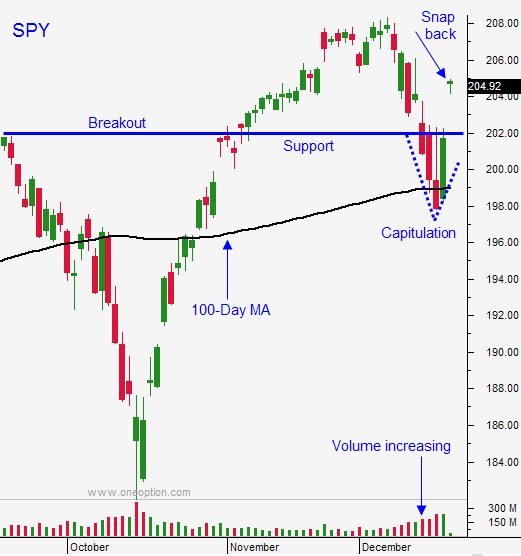

Yesterday, the market rallied above the 100-day moving average a few minutes after the open. Buyers stepped in ahead of the FOMC and now it looks like the capitulation low is in. The S&P 500 finished 40 points higher yesterday and it is up 26 points before the open today.

In my comments the last few weeks I've tried to stress two main points: this is a low probability trading environment and don't short into year-end strength.

I sold some out of the money put credit spreads a few weeks ago and they were in great shape. As conditions worsened, I used the S&P futures to hedge the position on an intraday basis. Overall, I made money on those trades.

When the market closed below the 100-day moving average on Tuesday, I bought some puts Tuesday. I shorted the S&P early Wednesday. I used the 100-day moving average as my stop. These trades were on a tight leash and I planned to exit before the FOMC. Within minutes after the open, I was stopped out and my losses were very small.

Stocks screamed before the FOMC and I believed that the phrase "considerable time" would be removed. Consequently, I didn't want to get long before the statement. Once the statement was released, the S&P instantly shot 15 points higher.

I also mentioned yesterday that central banks love to squeeze shorts ahead of options expiration. I have seen it many times and it happened in October (BOJ) and November (PBOC). I’m sure the Fed looked at global credit markets and said, “Let’s leave it in for another month.”

I did not construe Janet Yellen's remarks to be dovish. Their new phrase is "patient". When pressed for a timeline for tightening, she said at least two months. This is much sooner than the consensus timeline for the second half of 2015.

Russian credit concerns will be an issue. They don't have any allies and Putin has alienated the EU and the US.

Greek elections are not favoring the ruling party. They will go through a process that will last many weeks and it could have a slightly negative impact on the market.

The greater concern is China. Their flash PMI came in light (49.5 versus 50.2 expected), their commodity imports decreased 25% month over month, the government now projects 7% growth in 2015 (lower than expected) and the PBOC had to cut rates so that banks would have enough cash to get through the holidays. This is the largest economy in the world and any decrease in activity will impact us all.

I did not get long yesterday so I am missing the move this morning. I will be looking for an opportunity to sell out of the money put credit spreads in January. I like consumer discretionary stocks and I outlined some nice picks in the webinar last night.

The news will dry up next week and quiet markets favor the bulls. This is been an excellent year so I am not going to push the envelope.

If you're looking for year-end trades, focus on stocks that have not jumped and that held up well during the recent market selloff. Ideally, they have consolidated near the top of the range and the uptrend is intact. I want to see breakouts through horizontal resistance. These patterns will result in a sustained move. Again, please watch last night's webinar video. It has at least 10 great trades that are setting up right now.

.

.

Daily Bulletin Continues...