Market Should Find Support – Let This Wave of Profit Taking Run Its Course – Be Ready To Buy Calls

Tuesday 10:30 AM ET - I will be announcing my Deal of the Year during my webinar tomorrow night

REGISTER NOW

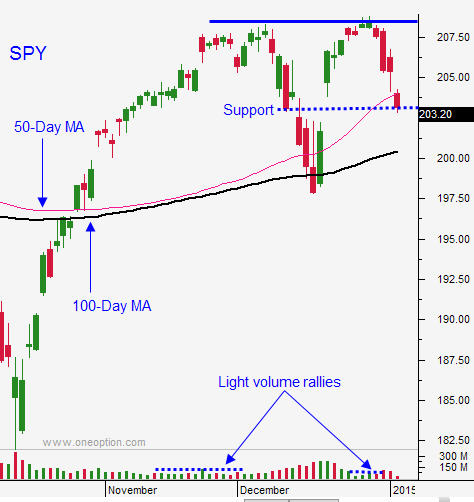

Yesterday, we saw a fairly heavy dose of profit-taking. The SPY easily breached the 50-day moving average ($204) and it tested horizontal support at $202. We might still have a little work to do on the downside, but I believe support at the 100-day moving average ($200) will hold.

If new Greek leaders are elected they could ignore fiscal constraints set up by the ECB/IMF. The EU feels that banks are in much better shape and the rhetoric from Angela Merkel suggests that Greece could be kicked out.

Oil prices continue to fall and credit concerns in Russia and Brazil could surface. China needs energy and it has been supporting the ruble.

Economic conditions in Europe are fragile and they could head into another recession.

These concerns are weighing on the market, but I don't believe they will have a lasting impact. Oil prices have been plummeting and they should find support soon. Greece has been a thorn in everyone's side for years and one way or another, the issue will be resolved. Economic conditions in the EU will be soft, but activity won't fall off a cliff. The same holds true for China. The possibility of additional central bank easing will keep a bid to the market.

ISM services was released and the 56.9 number was a little soft. This is still an excellent reading. ADP will be posted tomorrow and if we come close to expectations (230,000 new private sector jobs); the market will like the news. This will also bode well for Friday's Unemployment Report.

The FOMC minutes will be released tomorrow afternoon. The Fed has been accommodative and the rhetoric should be dovish.

Earnings season starts next week and I am expecting excellent profits outside of the energy sector. Oil/gasoline is a major cost for most companies and margins will improve. Retail/restaurant should do particularly well as consumers have an extra $30-$40 per week to spend.

Stocks floated higher into year-end as they normally do. The volume was light and bullish speculators piled in. Now they are getting flushed out.

January 2014 started off on a weak note and that pattern is being repeated. Don't get discouraged, the market had a great year.

I am day trading this decline. The plan I outlined yesterday worked beautifully. I shorted the S&P when the SPY traded below $204 and I used $202 as my target. Today, I will use $202 as my entry and stop. My target is SPY $200. That is the 100-day moving average and I'm expecting that support level to hold.

If you are long puts, note the trading range during the first hour. Use the high as your stop. If the SPY falls below $202, use that as your stop. I am keeping my short positions on a tight leash and I am not carrying any overnight shorts.

From a longer-term perspective, I am bullish. I feel that this dip will set up an excellent buying opportunity. I will monitor major support levels to see how sturdy/weak they are. If we hit an intraday air pocket and we stage a sharp reversal, I will know that buyers are ready to step in.

The market has performed well into the Unemployment Report recently and it tends to perform well into option expiration. We also have earning season on the horizon and that will attract buyers.

If you are playing the downside, be careful.

Swing traders, wait for support and get ready to buy.

.

.

Daily Bulletin Continues...