Market Starting 2015 On A Bearish Note – Just Like Jan 2014 – Dip Won’t Last Long

Posted 10:15 AM ET - My trading system got short SPY, DIA and QQQ last Friday. It works well for Indices, international ETFS, sectors, commodities and stocks

WATCH THIS VIDEO

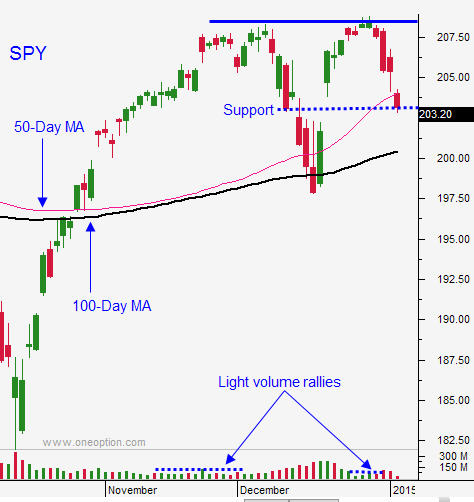

The market floated higher on light volume and we've seen how vulnerable these rallies can be to profit-taking. The price action has been bearish the last few days and the S&P 500 opened eight points lower this morning. We will test support at SPY $204 (50-day moving average).

Greece is being blamed for the recent wave of selling. Elections are up for grabs and if the anti-austerity party wins, they will abandon fiscal spending constraints. The EU feels that banking exposure has been reduced in the last two years and they might consider kicking Greece out of the union if this scenario unfolds. Greek bond yields are jumping.

Official PMI's were released last week and China was a little light. Government officials reduced growth expectations to 7% for 2015. China is the largest economy in the world and this is my biggest concern for 2015. An economic slowdown could result in shadow banking credit defaults.

Low oil prices will impact oil-producing nations. Russia and Brazil could also have credit issues.

Central banks are printing money like mad in an effort to maintain economic activity. This is been going on for years and QE is losing its punch.

Money has to go somewhere and it is flowing into US stocks and bonds. Domestic economic conditions are strong.

Consumer spending increased .6% and lower gasoline prices are helping. More than 70% of our economic activity is based on consumption and GDP rose 5% last quarter. Employment conditions are also improving.

Earnings season starts on January 12th and I am expecting excellent results (apart from the energy sector). Stocks have a tendency to rally into earnings season and this dip should run its course in the next two weeks.

ISM services will be released tomorrow and I'm expecting a good number. ADP will be posted on Wednesday and we should see 230,000 new jobs in the private sector. If we get this number it will bode well for Friday's Unemployment Report.

The FOMC minutes will be posted Wednesday afternoon. The Fed will remain accommodative. Global economic conditions are fragile and the dollar is climbing. This will eventually reduce US exports and the Fed will not raise rates until the end of 2015 – they don’t want the dollar to spike more than it has.

January 2014 was weak and we still had an excellent year. I believe the market will probe for support the next few days.

I have a clean slate and I shorted the S&P futures when the SPY fell below $204 this morning. I will use that as my stop. If the SPY falls to $202 today, I will use that as my stop and re-entry. I don't believe we will hit it today, but major support lies at SPY $200 (100-day moving average). I am short term bearish, but I won't carry any overnight positions.

On and intermediate basis, I am bullish. Greek elections and negotiations will drag on and conditions will stabilize. China's numbers will be a little light, but not dire. The ECB and PBOC could ease and that possibility will keep a bid to the market. US economic releases and earnings season will attract buyers.

This little wave of selling needs to run its course. I will be monitoring key technical support levels. If they fall easily, it will mean that we have more work to do on the downside. If they hold firm, it means that the market is ready to resume the rally. I am not going to jump the gun.

This low will be similar to the ones we've seen in the last two years. The market will hit an air pocket as it breaches major technical support levels and we will see a sharp intraday reversal. The next day stocks will advance – that is when we will scale into long positions.

Day traders, use the support levels I've outlined. Swing traders; wait for the capitulation low. This selloff should run its course quickly.

.

.

Daily Bulletin Continues...