Market Found Support – Bullish Specs Got Flushed Out – Calendar Looks Good

Wednesday 10:30 AM ET - I will be hosting a webinar tonight and we will look for new trades

REGISTER NOW

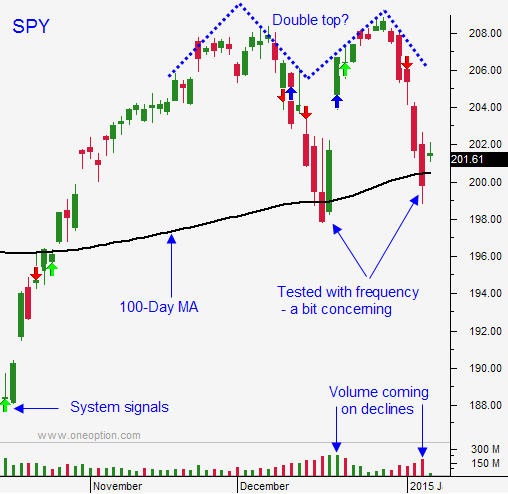

The market started the year off on a weak note and the 100-day moving average was breached yesterday. Buyers stepped in and we saw a sharp reversal off of the lows. In the last two years, this pattern has presented an excellent buying opportunity.

2015 is off to a fantastic start. In my comments Monday I told you to get short if the SPY breached $204. My target was $202 and once we were below it - it became my stop.

Yesterday, I told you to short the SPY if we traded below $202. I set my target at $200 and I told you to use that as your stop. Tuesday afternoon, we rallied above $200 and you should have been stopped out.

I also warned you about taking overnight short positions. This morning, the S&P 500 is up 21 points in early trading.

If you followed my advice you clipped 40 points out of the S&P 500 in two days. A 1 lot of the eminis requires $3000 in margin and you would be up $2000 by following my guideline.

I put hours into my analysis and I don't charge a penny for this blog. Please post a review on INVESTIMONIALS

ADP reported that 241,000 jobs were created in the private sector during the month of December. This bodes well for Friday's Unemployment Report and the market has had a tendency to rally into the number.

The FOMC minutes will be released this afternoon. We will see a mixed tone with some officials wanting to remove "considerable time" and some wanting to keep it in. Any nervous reaction should quickly dissipate since most analysts are not forecasting a rate hike until Q4.

Economic conditions are slipping in Europe and they are likely to go into another recession. China's GDP could fall to 7.2% and that will raise concerns. The possibility of central bank easing will keep a bid to the market.

The ECB will release its statement tomorrow. They will not be able to roll out their sovereign debt purchase program, but the comments will be dovish.

Earnings season will kick off next week and apart from the energy sector, the results should be excellent. The market has a tendency to rally into earnings. Option expiration has also been bullish and stocks have rallied the week of option expiration during the last four months.

You know from my comments that I felt this dip would be short-lived. We were waiting for a capitulation low that breached a major moving average and we got it yesterday.

Yesterday I took profits on my emini short when we crossed back above SPY $200 and I sold out of the money put spreads late in the day. This morning, I am selling more put spreads, but I am not buying calls - yet.

We could see a little nervousness after the FOMC minutes this afternoon. I will use SPY $199.80 as my stop for my put credit spreads. I don't want to see us take out the low from yesterday and I don't believe we will.

If the market dips after the FOMC minutes and it quickly finds support, I will buy calls.

I urged you to be nimble on the short side and two maintain tight stops. Hopefully you did.

Swing traders, I advised you to wait patiently. It's time to sell some out of the money put spreads - prepare to buy some call options.

.

.

Daily Bulletin Continues...