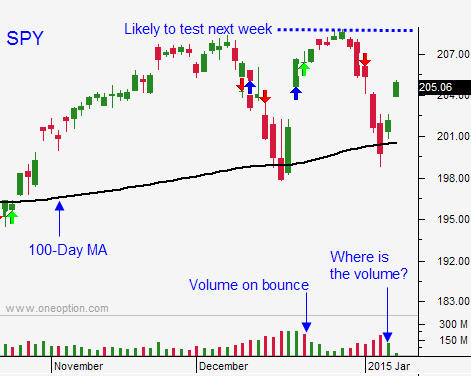

Market Will Make A New All-Time High Next Week – Sell Put Spreads – Buy Calls On Dips

Posted 10:30 AM ET - This week the market closed below the 100-day moving average and buyers stepped in immediately. In the last few years, this has been an excellent entry point for long positions. I've been telling you this week that the dip will be brief and that the better trade will come on the upside. The S&P 500 is up 26 points after 30 minutes of trading this morning.

The calendar is bullish. ADP reported that 241,000 new jobs were created in the private sector during the month of December. This Goldilocks number bodes well for Friday's jobs report. Stocks have had a tendency to rally into the number. Earnings season kicks off next week and that also has a bullish bias. During each of the last four option expiration weeks, the market has rallied an average of 1.5%. All of these factors are coming into play.

Oil should find a floor soon. I'm not looking for a rebound, but it will stop going down.

Economic conditions in Europe are fragile, but don't worry. The ECB will promise to ease. China's economic conditions could also start slipping. It is difficult to maintain 7.5% GDP growth for more than a decade. The PBOC will jump in the action when needed.

Greece could be an issue in coming months, but it won't impact us during the next few weeks. The markets are not too nervous about Greece getting kicked out of the EU. Banks have reduced risk and they are in much better shape than they were two years ago. Even if the new party wins elections, politicians will play "chicken" with the ECB for many months.

Interest rates are near historic lows and equities are attractive on a relative basis.

Yesterday I sold some out of the money put credit spreads and I bought the S&P futures for a day trade when the SPY traded above $201.70. I also bought some calls, but my position is relatively small.

I am very focused on stocks that are in an uptrend and are breaking out to a new relative high. I am selling at the money put credit spreads that expire in January and I'm using the breakout as my stop. I highlighted some of these trades in my webinar last night.

CLICK HERE TO VIEW IT

The price action is very strong and the high will be challenged next week.

If you missed this move, start by selling some out of the money put credit spreads on strong stocks. Wait for a small pullback and gradually scale into call positions. Look for stocks that are breaking through horizontal resistance and that are in an uptrend. Don't focus on the dogs and don't trade bounces. Stick with momentum.

This rally will last at least a couple of weeks.

The S&P futures are up 30 points now and they've gotten a little ahead of themselves. We should see a pullback this morning and that will be your opportunity to put some trades on. The price action will be similar to what we saw yesterday.

.

.

Daily Bulletin Continues...